There was an increase of 15 registered businesses compared to year 2020

Employment Status

Major Projects

- Tanami Expansion 2 (TE2) Project

- New Youth Justice Centre

- Middle Arm Industrial Precinct

- Darwin Airport Upgrades

- Charles Darwin University (CDU) Education & Community Precinct Project

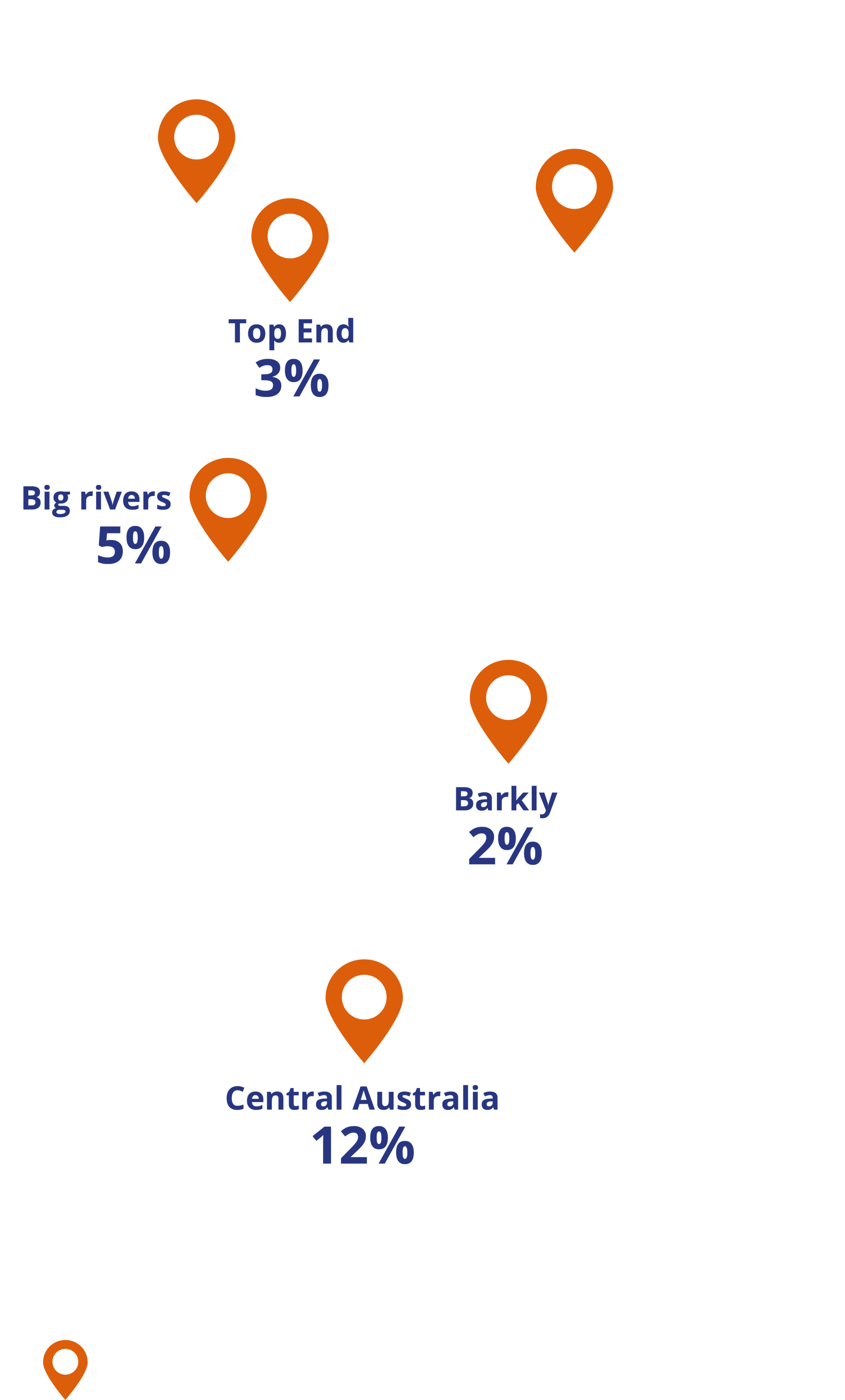

Industry Workforce by Region

Age & Gender of the Workforce

Apprenticeships and Traineeships (2021)

Total

Commencements

1242

Total

Completions

242

Occupations in Demand & Number of Workers in NT

- Electrician (General) (2400)

- Metal Fabricator (821)

- Carpenter (766)

- Safety Inspector (114)

- Civil Engineering Technician (83)

Skills in Demand

- Electrical skills

- Mechanical and building

- Wall cladding

- Project delivery

- Critical thinking

Workforce Challenges

- Shortage of skilled workforce

- Dissatisfaction with casual jobs

- Lack of training on the job

- High salary expectations

- Higher interstate relocation costs

Transferable Occupations & Skills

Example

Training a Fencer

to become a Metal

Fabricator with a skill match of 86%

The construction industry in Australia comprises a large number of non-employing businesses and small businesses employing less than 20 people. The sector depends on imported materials (25-30%) for its construction purposes. It is also a heavily regulated industry with varying regulations across government levels, sub-sectors, and occupations. The Vocational Education and Training (VET) sector plays a vital role in providing specific practical skills and qualifications to the industry's workforce. The VET sector also provides credentials to prospective industry workers to meet the eligibility requirements for an occupational licence or legislative requirements.

The industry generates over $360 billion in revenue annually, which constitutes 9% of Australia's Gross Domestic Product (GDP). The share of the construction industry's contribution to the GDP makes it the third largest sector in Australia. For the past 5 years (2015-2020), the industry at the national level has experienced a decline in construction activities. The decrease in the contribution of the industry has mainly been caused by a steady downturn in residential buildings, a fall in mining investments and reduced government spending on heavy and civil engineering projects. These projects include power generation capacity, water supply resources and others. However, the sector's contribution to the GDP is projected to increase by 2.4% annually over the next 5 years. In terms of employment, the Australian construction industry employs approximately 1.2 million people, which is 9% of the national workforce. Since 2015, employment numbers have fallen, nevertheless, projections from the Australian Bureau of Statistics (ABS) show a projected growth of about 80,000 workers by 2025. The growth of the construction industry's employment in the future is linked to an expected increase in demand for housing, commercial buildings, social spaces, and infrastructure as Australia's population grows. The Federal and state/territory governments' commitment to increase infrastructural investment to catch up with the infrastructure backlog will also create further demand for construction workers.

PERCENTAGE OF CONSTRUCTION WORKFORCE

Source: ABS Labour Force Survey, November 2020

Technological adoption and acceleration are changing many facets of construction activities, skills, and workforce training needs of the industry. The integration of advanced technologies such as drones, radio frequency identification, 3D printing and 4D scheduling in construction activities have created new job opportunities requiring new skillsets. For instance, drones are replacing traditional surveillance methods, serving as real-time monitoring systems, and maintaining the safety of workers on construction sites. Moreover, 3D printed and pre-fabrication construction robots are used in the construction industry to reduce waste and enhance the efficiency of work and environmental sustainability. These new technologies will, furthermore, require specialised operators to function efficiently within the industry. With the ever-changing and evolving nature of modern technologies, it is essential to prepare the Australian construction workforce to adapt to these skills adjustments.

The Australian construction industry is an economic priority with a strong connection to all industries, creating millions of jobs, contributing billions of dollars to GDP, training thousands of apprentices, driving wider economic growth and building better communities.

Master Builders Australia, 2021

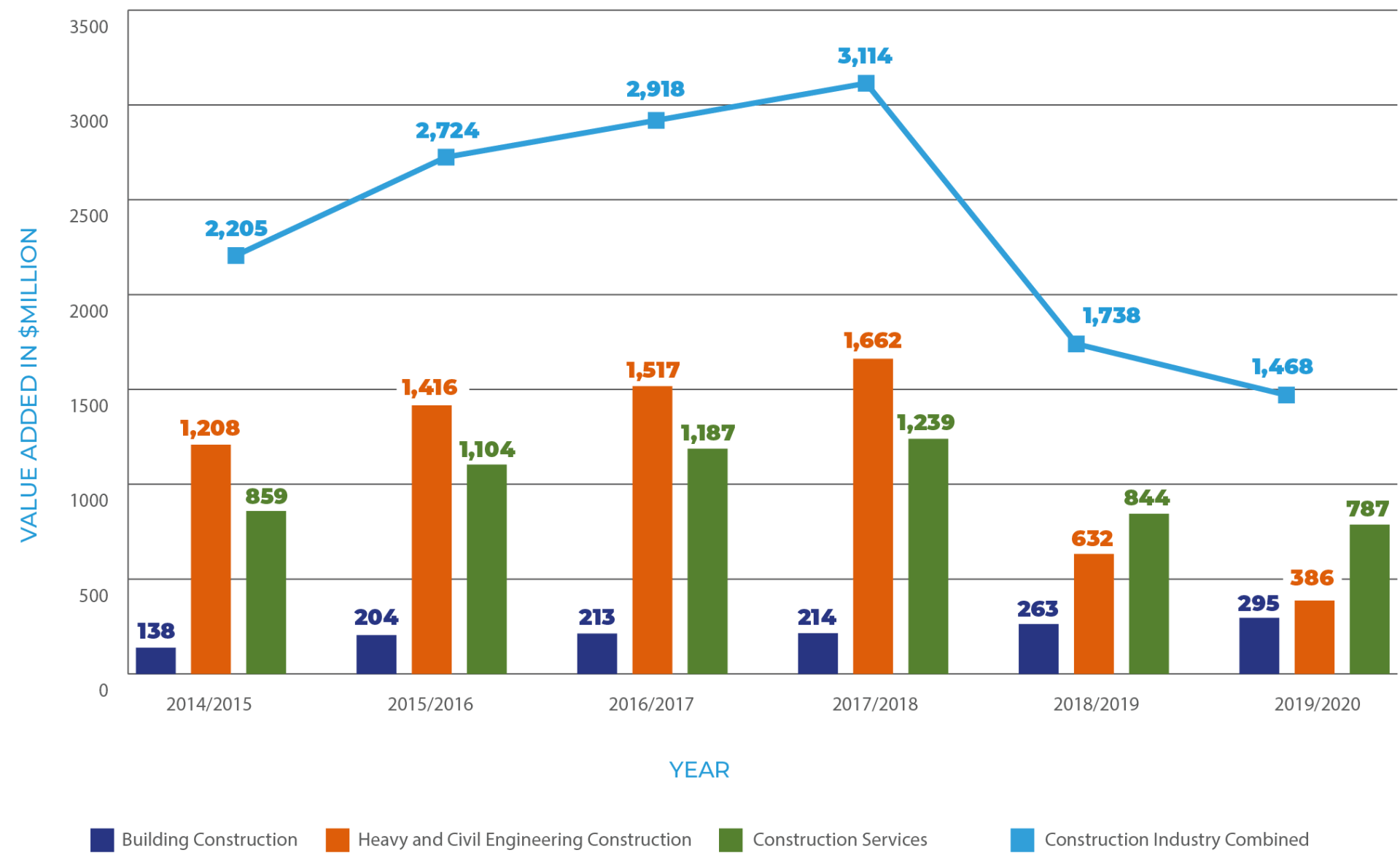

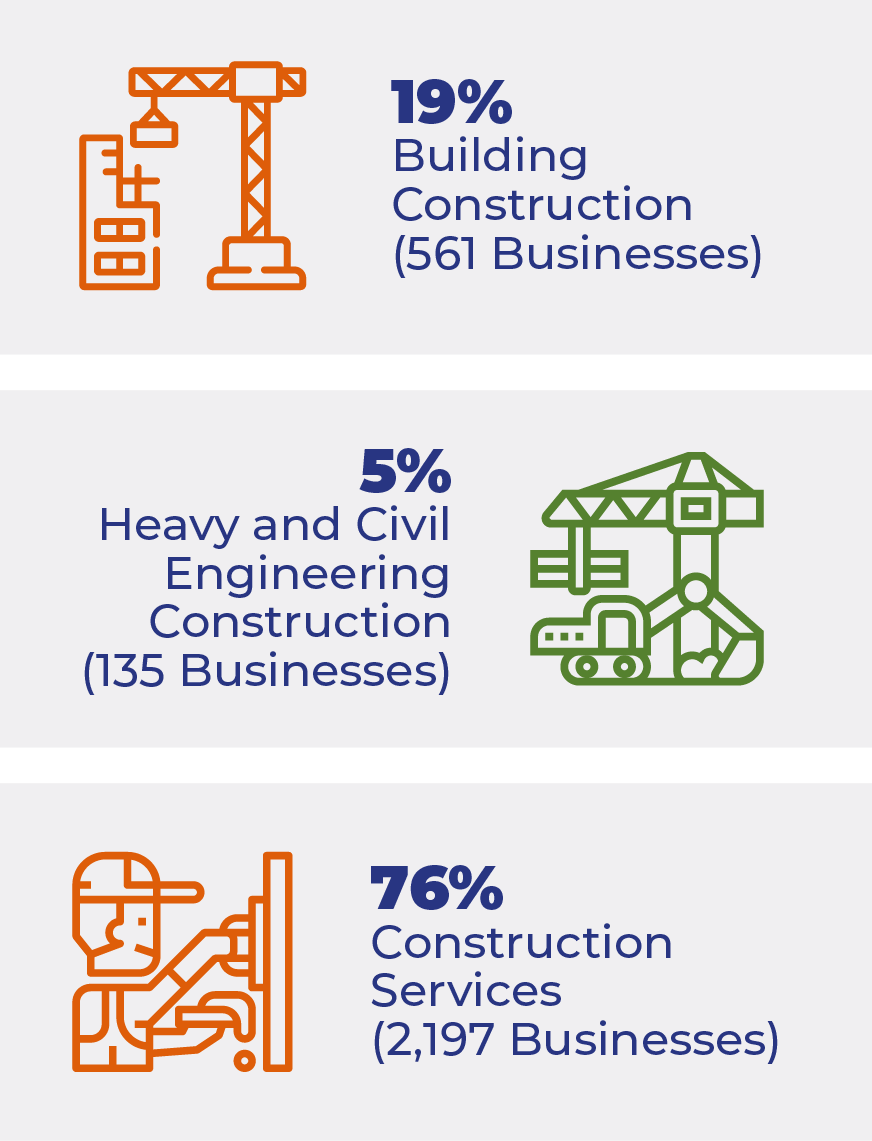

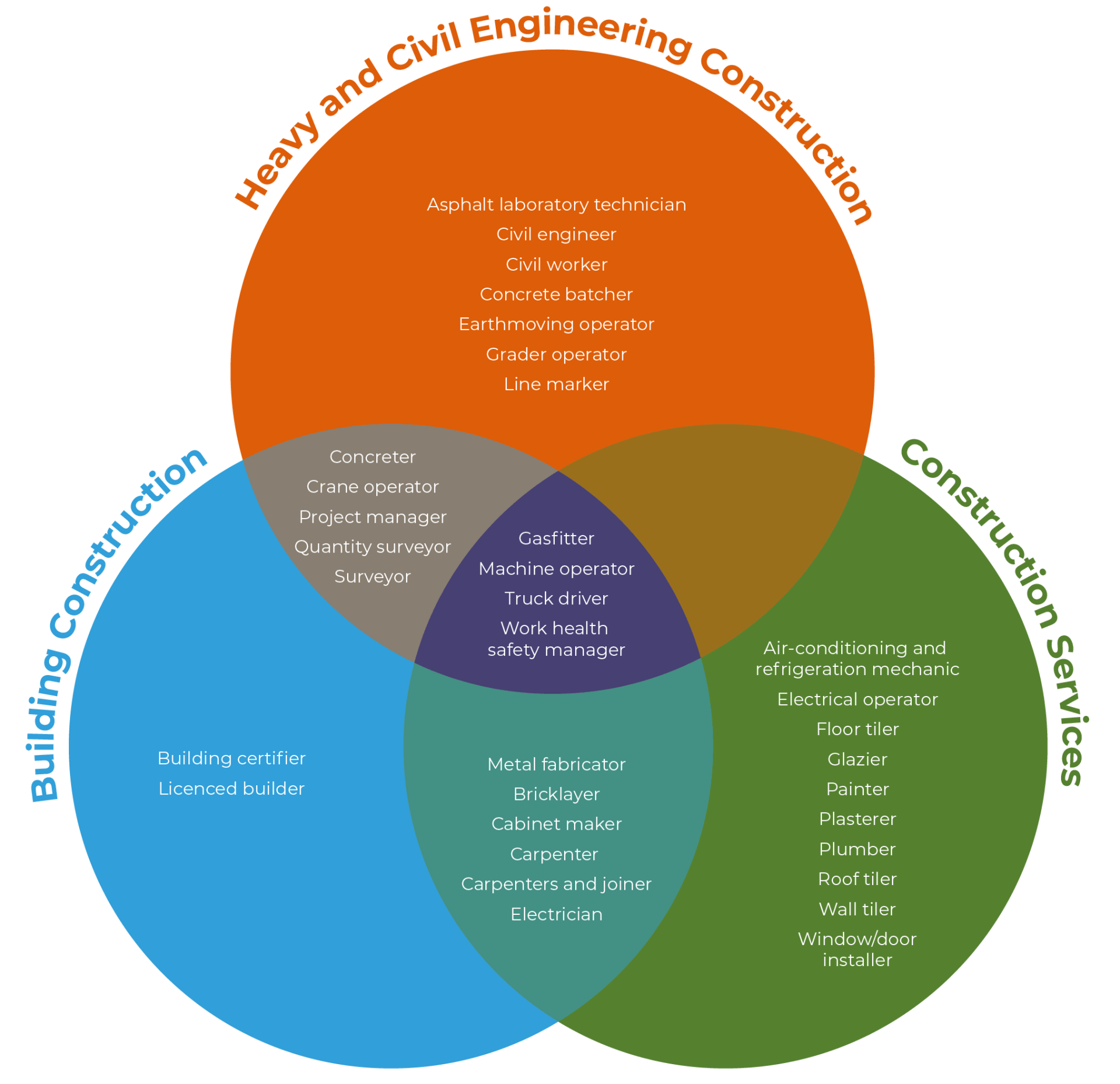

Sub-sectors of the Construction Industry

The construction industry, based on ABS categorisation, broadly comprises 3 sub-sectors. These are; building construction, heavy and civil engineering construction, and construction services.

Building construction as a sub-sector primarily involves the construction, repair and maintenance of buildings. The sub-sector is further divided into residential, non-residential and other residential construction.

Heavy and civil engineering construction sub-industry encompasses the construction, reconstruction, rehabilitation, and repairs of civil infrastructure. Activities under this sub-sector include, but not limited to, the construction of roads, highways, airport runways, bridges, dams, power and water stations.

Construction services is a component of the construction industry that involves the preparation and development of land for construction purposes. It also includes installing, servicing and furnishing works to end the construction process. Activities such as concreting, bricklaying, plastering, roofing, electrical, plumbing, carpentry, tiling, glazing, painting, air conditioning and heating are classified under this industry.

Northern Territory's Construction Industry

The construction industry, for a decade, has been among the top 5 contributors to the Northern Territory's (NT) Gross State Product (GSP) and employment. Between 2010-2020, the construction industry, on average, employed 10.3% of the NT's workforce and accounted for over 10% of the GSP. However, the past few years have seen the sector's contribution to GSP and employment significantly reduced. For instance, the construction industry's contribution to GSP was 5.9% in 2020, down from 12.8% in 2017. Similarly, the industry's employment share reduced from 11.6% in 2016 to 8.2% in 2020. The decline in residential construction investments and the completion of major heavy and civil engineering construction projects have all contributed to the downward trends.

Aerial photo of Maryvale road construction in Alice Springs

In recent times, efforts to make the construction industry more vibrant and capable of accelerating the NT's COVID-19 recovery process have been more concentrated. This has seen an increase in stimulus packages in the form of government grants and funding. In effect, an industry boom has occurred and resulted in acute workforce shortages and retention issues. Likewise, the adoption of emerging technologies across the industry's sub-sectors has created new occupations and skillsets that are mostly challenging to fill. These factors, coupled with the sector's potential to expand and the growing adoption of advanced technology in the next few years, may create training gaps and exacerbate existing workforce challenges already confronting the industry. Unfortunately, up-to-date workforce data for the construction industry, as a whole, in the NT is difficult to obtain. This has sometimes hindered workforce planning and development, which is key to the industry's long-term growth and sustainability. This Insight provides a snapshot of the skills and occupations in demand, together with training gaps in the construction workforce.

VALUE ADDED BY SUB-INDUSTRY IN THE NT

SSource: National Institute of Economic and Industry Research (NIEIR), 2021

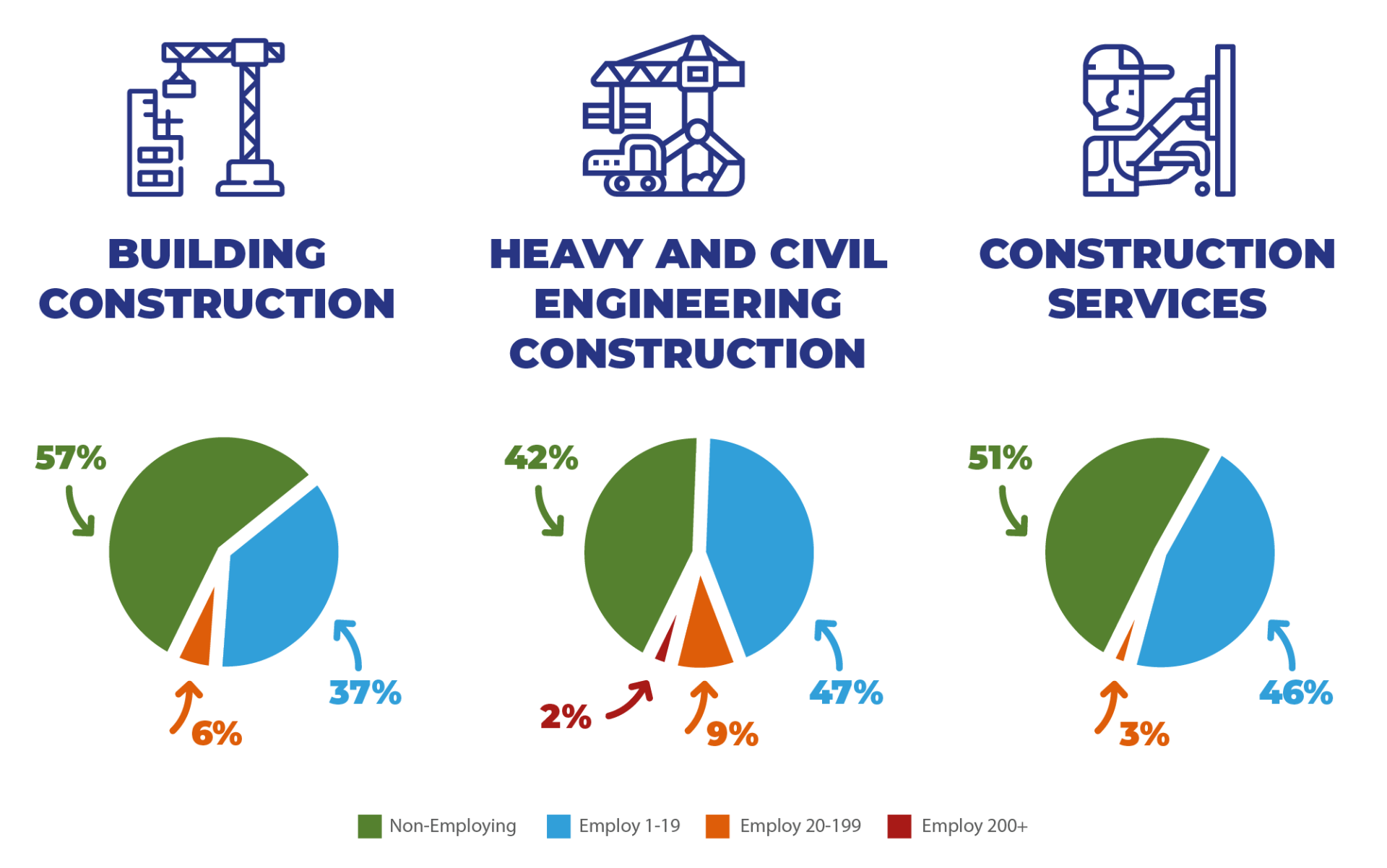

NT'S INDUSTRY SIZE BY BUSINESS COUNT

Source: ABS, Counts of Australian Businesses, including Entries and Exits, Cat no 8165.0, June 2016 to June 2020

SIZE OF NT'S INDUSTRY BY EMPLOYMENT

Source: ABS, Counts of Australian Businesses, including Entries and Exits, Cat no 8165.0, June 2016 to June 2020

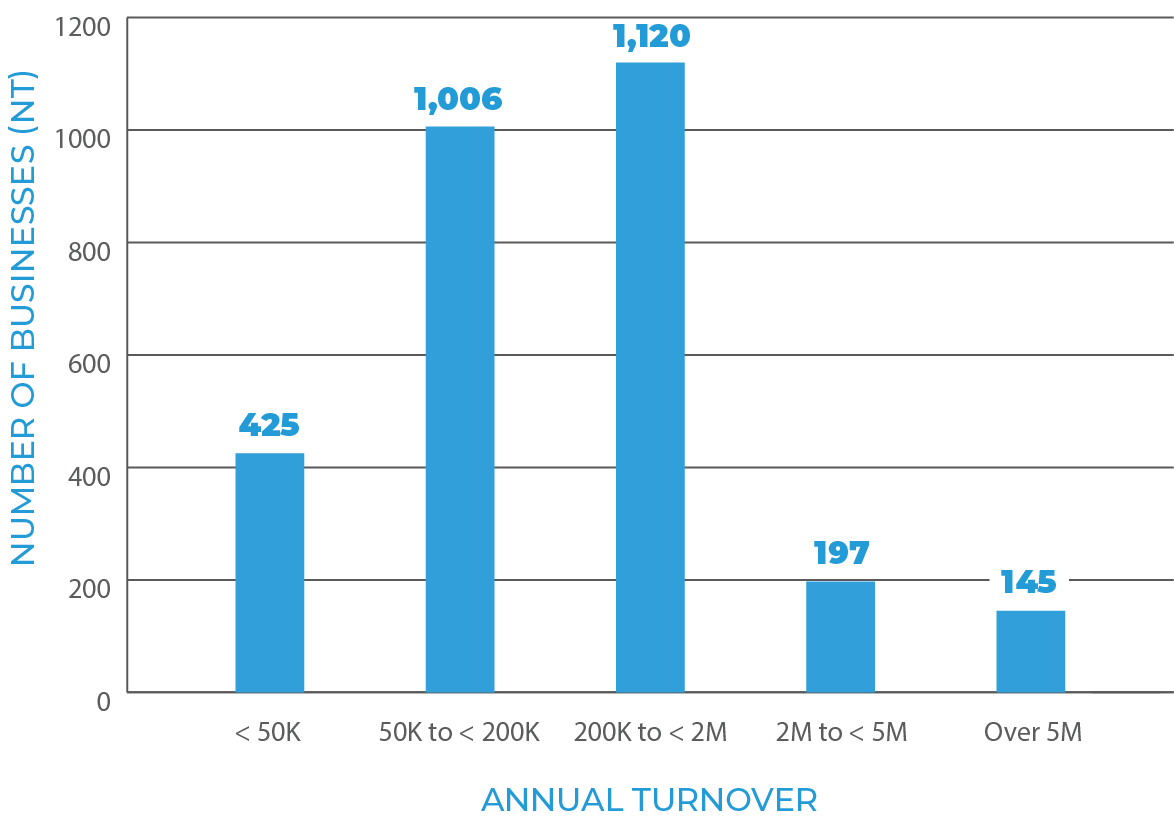

SIZE OF NT BUSINESSES BY ANNUAL TURNOVER

Source: Counts of Australian Businesses, including Entries and Exits, Cat no 8165.0, June 2016 to June 2020

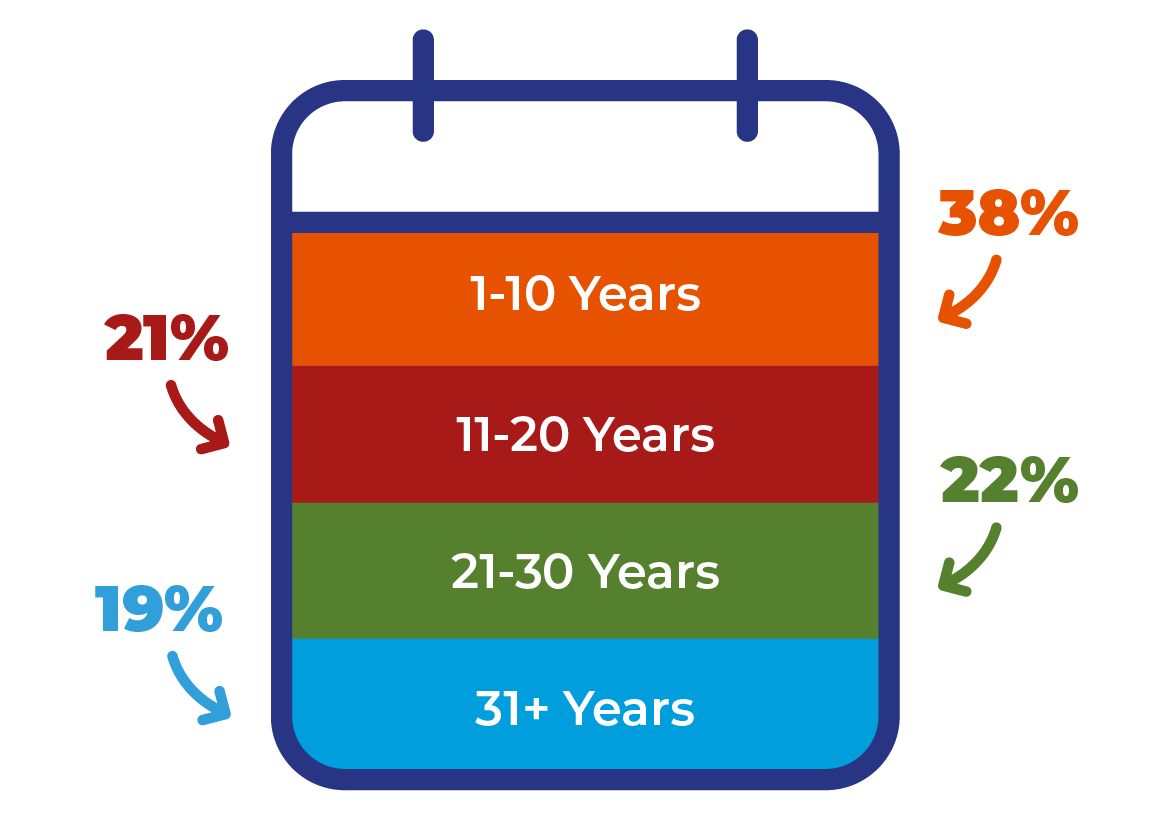

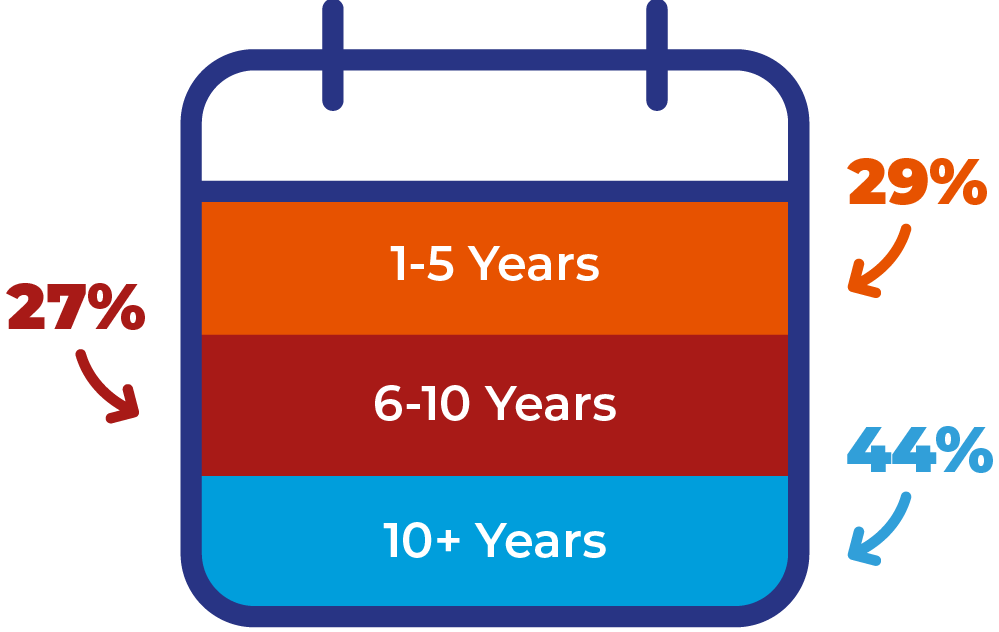

YEARS OF BUSINESS OPERATION

Source: ISACNT Field Survey, 2021

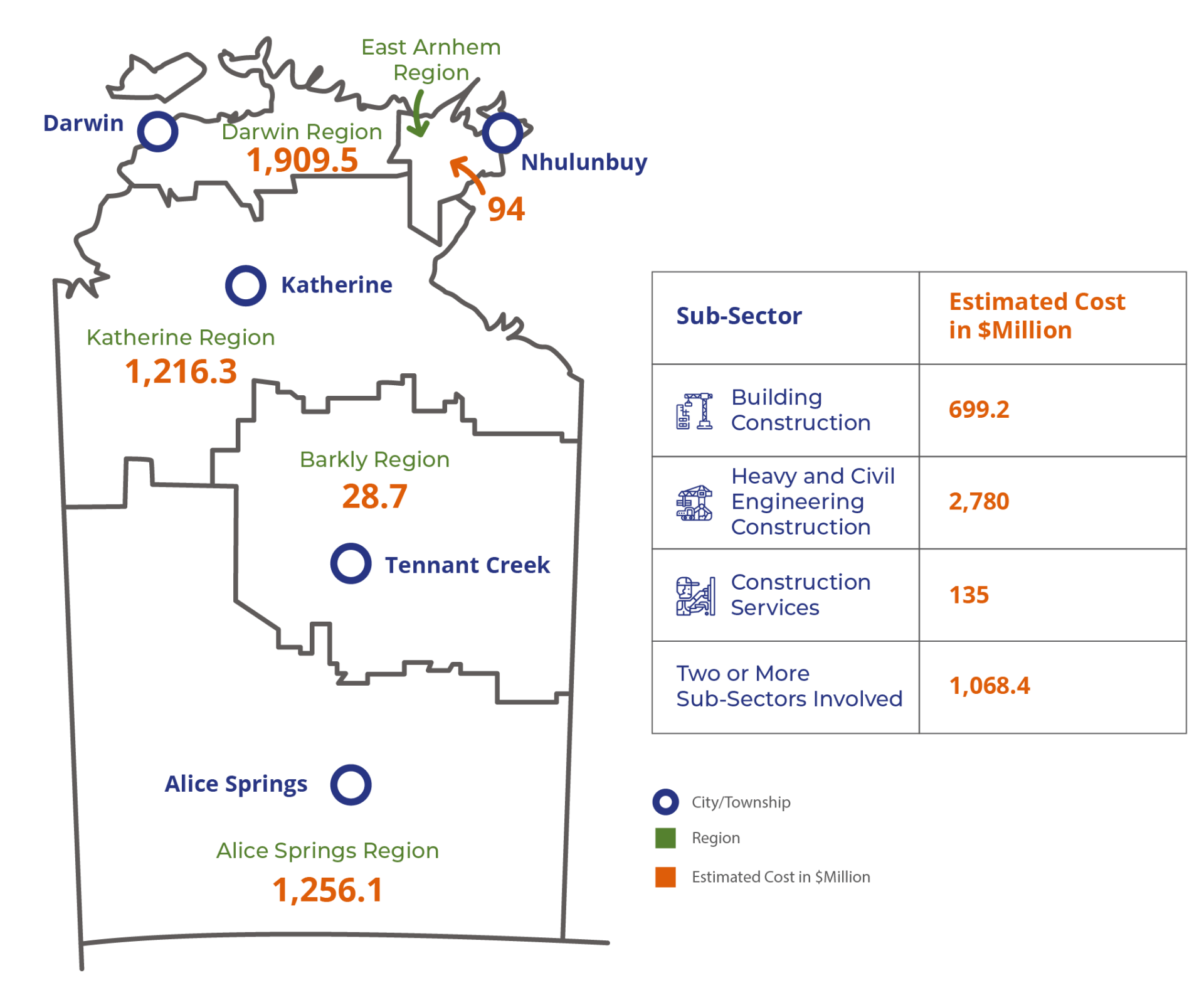

Distribution and Cost of Ongoing Construction Projects

The Northern Territory Government (NTG) aspires to achieve an economy valued at $40 billion by 2030, which is expected to drive the Territory's population to grow above 300,000. Economic development and population growth imply the need for infrastructural expansion and workforce development. As a result, the NTG, together with the private sector, annually undertake significant infrastructural investments across all industries and regions of the economy to keep up with the pace of the expected future growth. The monetary value of infrastructural investment varies across the sectors and regions of the NT.

DISTRIBUTION AND COST OF ONGOING CONSTRUCTION PROJECTS

Source: Department of Infrastructure, Planning and Logistics, 2021

Note: Territory-wide construction projects estimate equivalent to $178 Million has been excluded from the map.

Industry Intelligence

Workforce studies are key to achieving sustainable workforce planning in any industry. Unfortunately, obtaining relevant and current workforce intelligence for the NT's construction industry is often challenging, as limited data exists. The general deficiency of quality workforce data coupled with the increased workload from numerous stimulus packages impacting all sub-industries have created a boom and intensified workforce challenges, thus highlighting the importance of the workforce study. Similarly, the implementation of the recommendations from the Building Confidence Report (for example, compulsory continuing professional development) and changes to the National Training Framework for the National Traffic Management, may impact the workforce and construction training delivery.

The Industry Skills Advisory Council Northern Territory (ISACNT) on a yearly basis collects industry specific occupational intelligence for the NT. The analysis of the intelligence coupled with the ongoing changes in the construction industry formed the basis for ISACNT to explore the sector further. As a result, the ISACNT undertook an in-depth study of the construction industry in the NT exploring the workforce demographics, challenges, occupations in demand, skills and training gaps. ISACNT contacted 304 construction businesses in the NT, with 96 businesses participating in the study. These 96 in-depth stakeholder engagements with construction businesses cut across the 3 sub-industries and the 5 main regions in the NT. The response rate from the stakeholder engagements was 31.6%. ISACNT also engaged with 6 industry associations (peak bodies) in the construction industry. Moreover, a focus group discussion comprising of stakeholders across the sub-sectors of the construction industry was conducted to further explore key issues and validate the findings from the engagements and literature reviews.

Regional response rates

- Darwin 26.5%

- East Arnhem 12.5%

- Katherine 66.7%

- Barkly 18.2%

- Alice Springs 35.2%

The Northern Australia Roads of Strategic Importance (ROSI) initiative reserves $1.5 billion to build on the benefits of the Australian Government's Northern Australia Roads Program and Northern Australia Beef Roads Program. This is envisaged to improve productivity and efficiency on key freight roads, providing better connections between agricultural regions and ports, airports and other transport hubs to better access tourism, mining, and other sectors.

Department of Infrastructure, Transport, Regional Development and Communication, 2018

Socio-Demographics of the NT's Construction Workforce

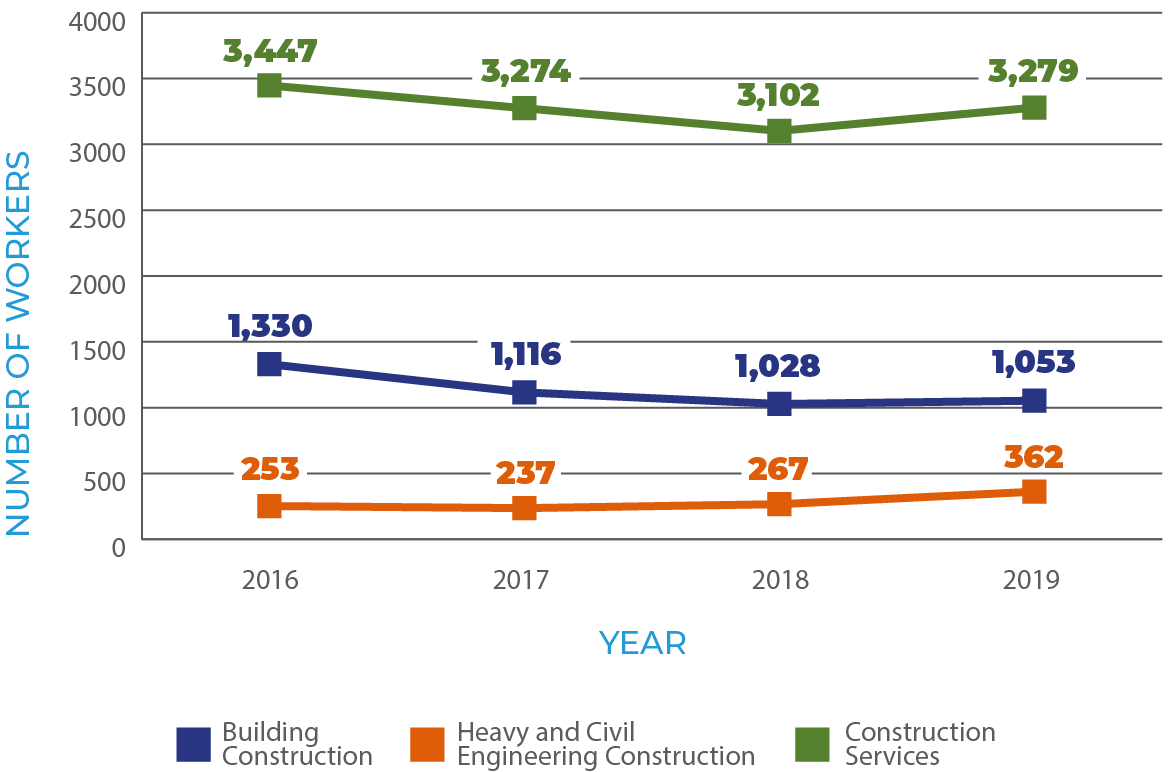

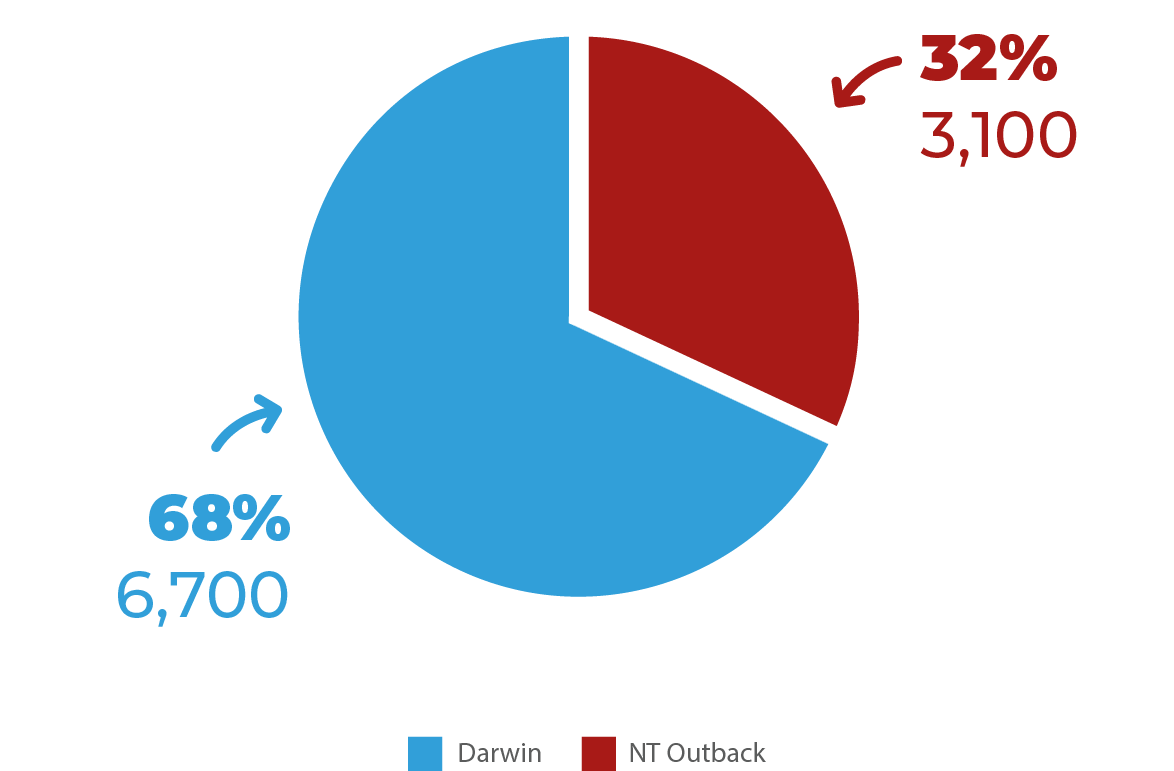

The construction industry in the Northern Territory is experiencing a significant transformation in workforce diversity, skills, and training requirements. The sector is also characterised by a recurring workforce shortage, driven mainly by government spending and investments in infrastructure. The number of construction workers employed in the sector varies significantly across the sub-sectors and regions. The construction industry's workforce in the Territory constitutes 70% of construction services workers, 24% of building construction workers and 6% of heavy and civil engineering construction employees. In relation to the distribution of construction employment in the NT, the ABS estimates that two-thirds of the workforce is located in Darwin, while one-third of the labour force is found in Outback NT (everywhere in the NT except the Greater Darwin area).

SUB-SECTOR EMPLOYMENT TRENDS

Source: National Institute of Economic and Industry Research (NIEIR), 2021

EMPLOYMENT DISTRIBUTION

Source: ABS Labour Force Survey, February 2021

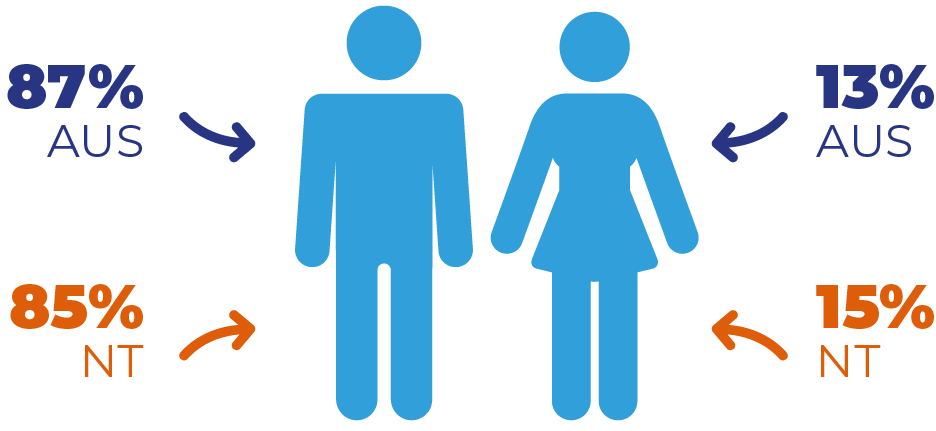

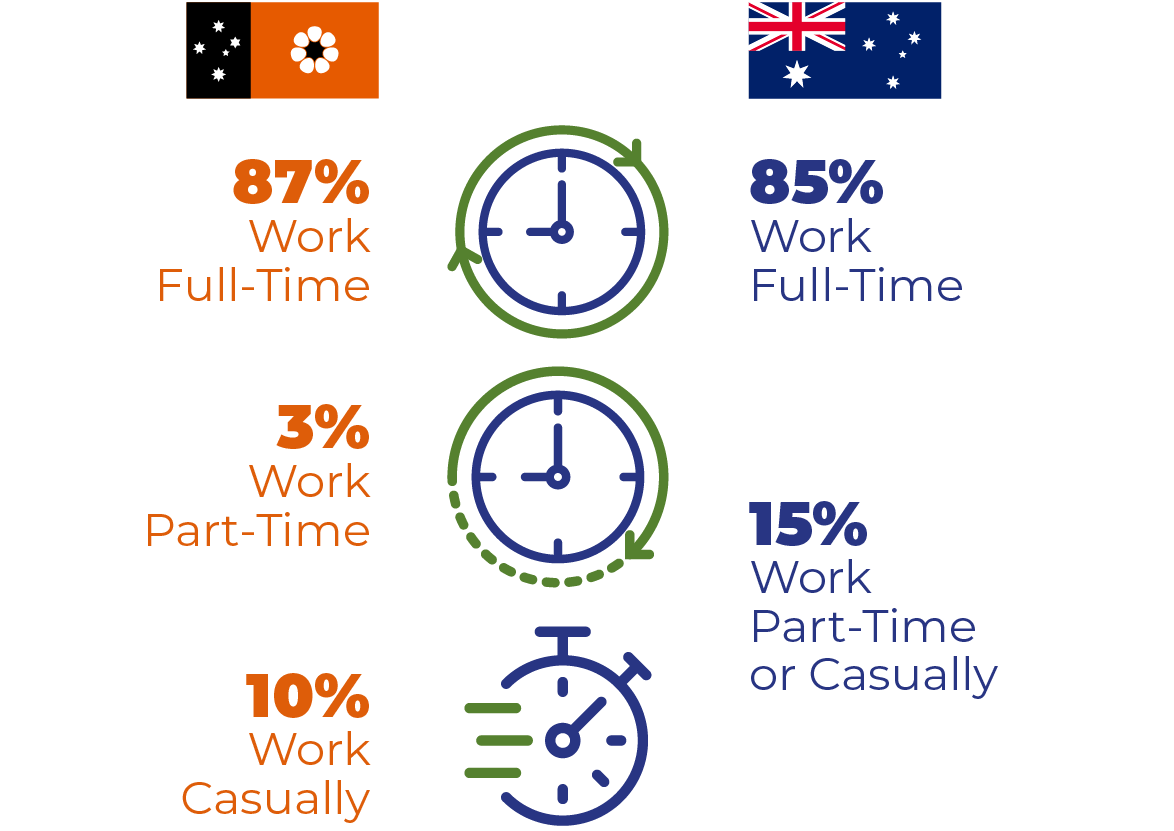

Construction is a heavily male-dominated industry. The lower female representation in the workforce may be explained by the industry's physically demanding work together with long and irregular working hours. Findings from ISACNT's stakeholder engagements revealed that the women working in the sector primarily are clustered in support roles such as administration and human resources. The sector's workforce in the NT is more diversified compared to the national average in relation to age, work experience, Indigenous and residency status, basis of employment and qualifications. Apart from the Australian Capital Territory, the NT's construction sector employs more full-time workers than any other state in Australia. ISACNT's engagements with construction stakeholders demonstrated that businesses with continuous and stable job contracts often provide full-time permanent positions and assure employees job security.

GENDER DISTRIBUTION

Source: ISACNT Field Survey, 2021 and ABS Labour Force Survey, February 2021

BASIS OF EMPLOYMENT

Source: ISACNT Field Survey, 2021 and ABS Labour Force Survey, February 2021Source: ISACNT Field Survey, 2021

The under-representation of women in the construction industry synonymously means untapped resources to unlock the sector’s productivity potentials. Encouraging greater female participation in the industry is an important step towards addressing skills and workforce shortages, as well as fostering diversity.

Construction Skills, Queensland, 2021

Diversity is one of the greatest strengths of the Territory's construction workforce. The workforce comprises people from different cultural backgrounds, residency status, years of experience, and qualification levels. This aspect of the industry helps construction businesses in the NT attract talented individuals to fill critical workforce gaps. Stakeholders who participated in the study indicated the role of workforce diversity as a great foundation for building innovation, creativity and performance in projects. Concerning the employment of Aboriginal and Torres Strait Islander peoples, 6.4% of the NT's construction workforce in 2016 had an Indigenous background. This percentage was the highest across all states in Australia, demonstrating that the construction industry in the NT leads the way in engaging the Indigenous workforce. The sector does not rely much on skilled migrants in addressing workforce shortages.

Most construction businesses that participated in ISACNT's stakeholder engagements indicated the high cost of sponsoring skilled migrants and the strict bureaucratic process of getting the skills and qualifications of migrants assessed and approved as an impediment to employing overseas workers. However, results from the engagements revealed that having a mix of workers with Indigenous background, qualifications, age, and experience foster out-of-the-box thinking and generate new and innovative ideas. For example, through workplace diversity, new methods, and approaches for undertaking certain activities have reduced cost, improved efficiency and quality of construction outcomes of some projects.

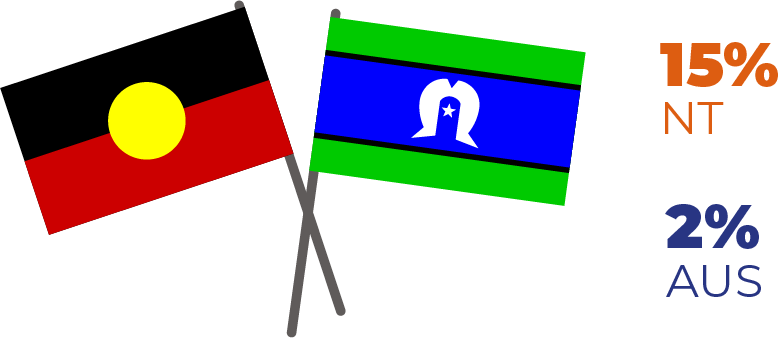

INDIGENOUS STATUS OF THE WORKFORCE

Source: ISACNT Field Survey, 2021 and Australian Bureau of Statistics, 2016

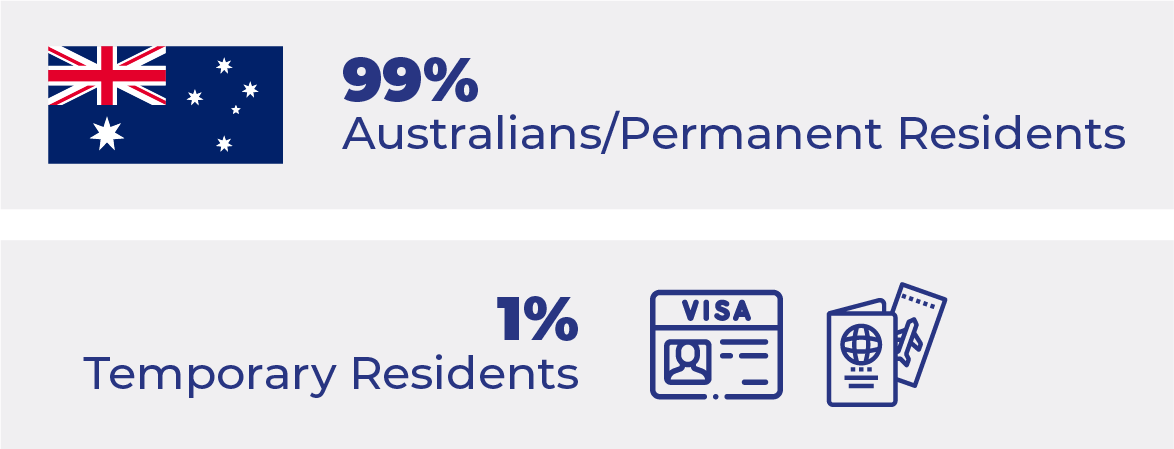

RESIDENCY STATUS OF THE WORKFORCE

Source: ISACNT Field Survey, 2021

Economic development at the Indigenous business enterprise level and individual Indigenous employees is a priority of the Northern Territory Government (NTG). To achieve this, Indigenous participation has been a mandatory requirement for all tenders for NTG construction contracts for Tier 4 ($500,000 but less than $2 million) and Tier 5 ($2 million and greater) procurement activities.

Department of Infrastructure, Planning and Logistics, 2018

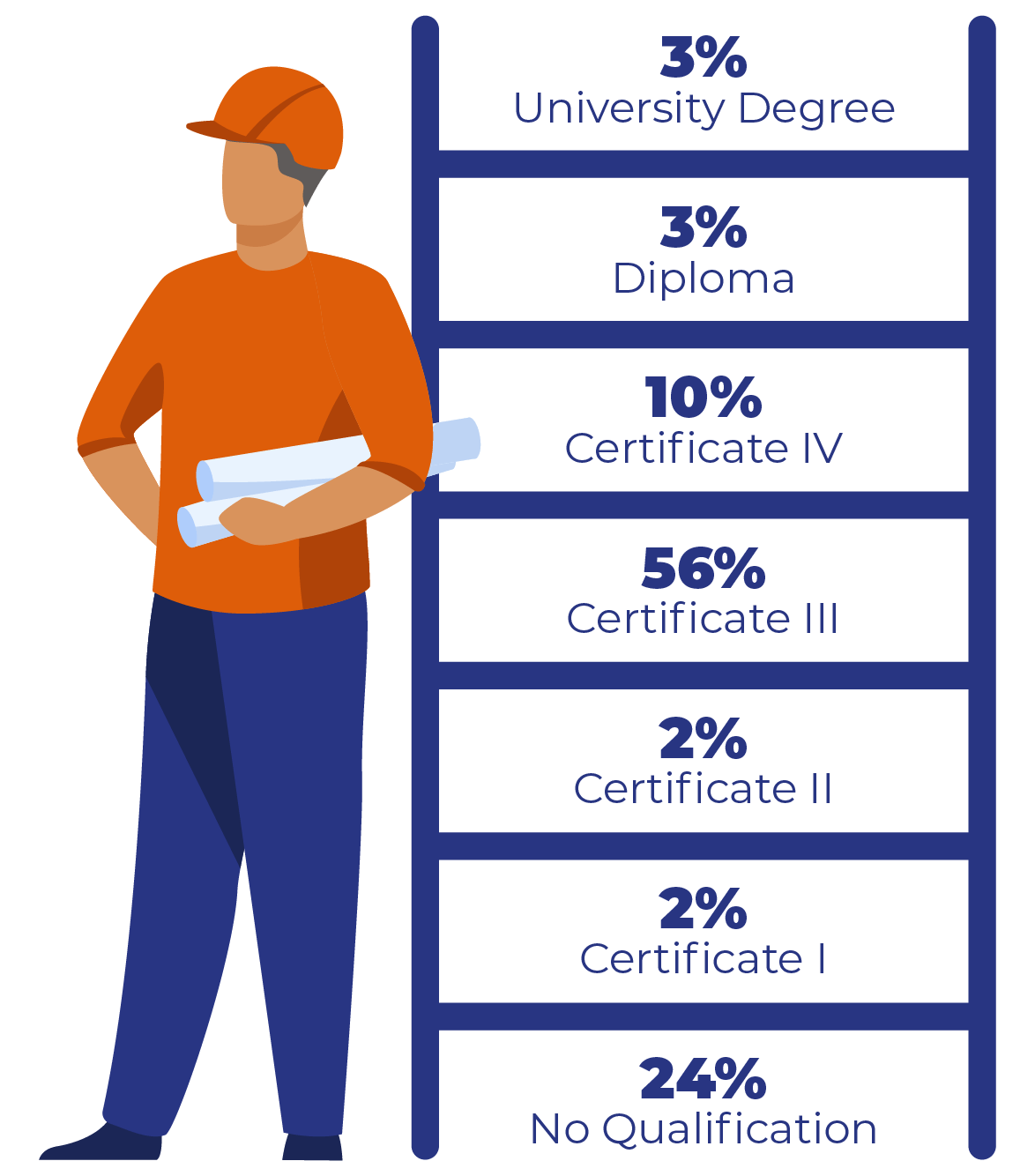

QUALIFICATIONS OF THE WORKFORCE

Source: ISACNT Field Survey, 2021

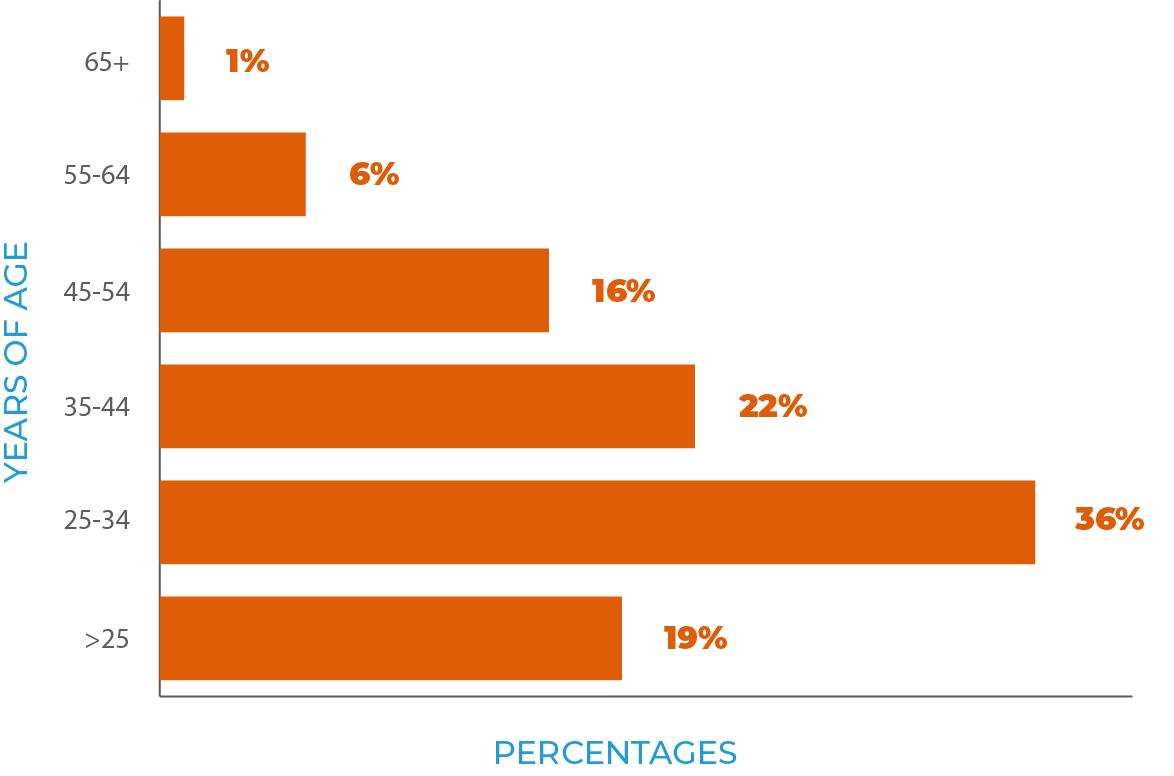

AGE OF THE WORKFORCE

Source: ISACNT Field Survey, 2021

EXPERIENCE OF THE WORKFORCE

Source: ISACNT Field Survey, 2021

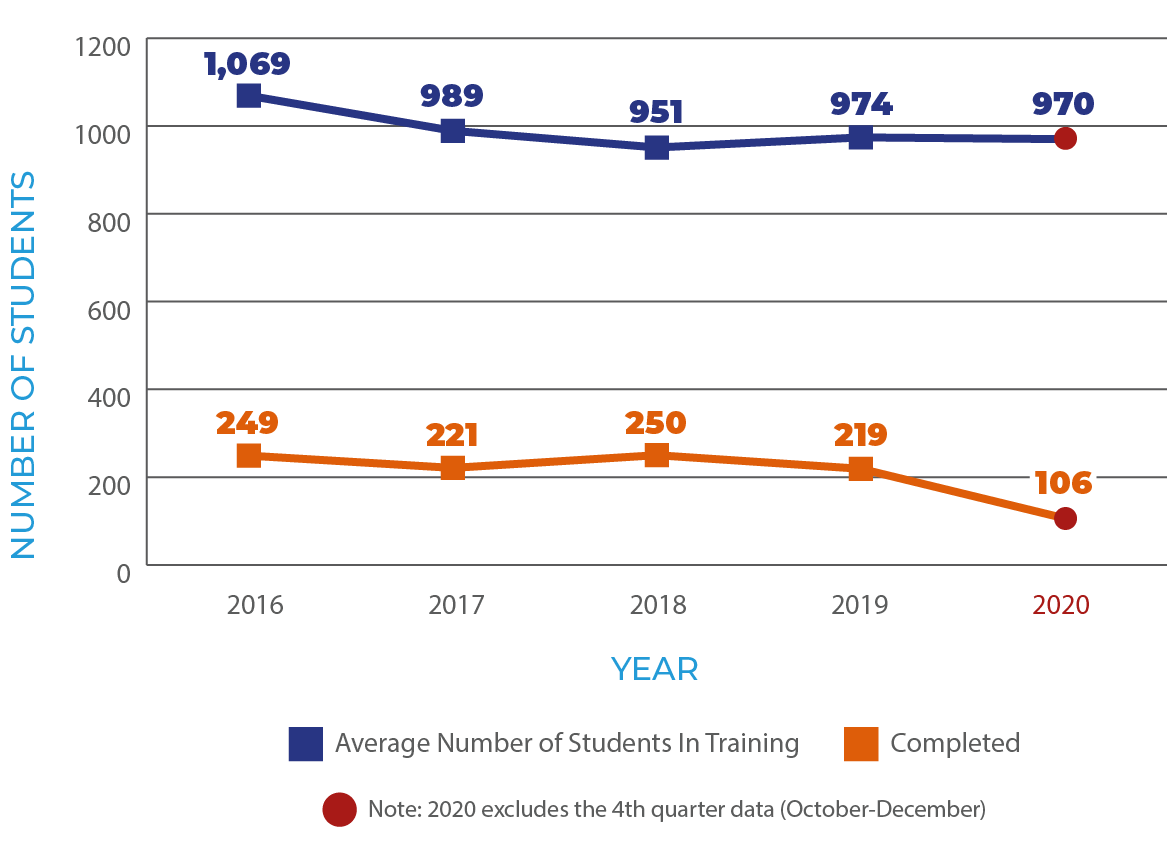

APPRENTICESHIP/TRAINEESHIP TRENDS IN THE NT

Source: National Centre for Vocational Education Research, 2016-2020

Construction businesses are increasingly experiencing widespread shortages in construction trades across the regions of the Northern Territory. The struggles to find suitably qualified construction trade workers is growing at an alarming rate year after year. This, if not urgently looked at, could result in the closure of many local businesses and render the sector less competitive and productive.

Collective view from ISACNT Field Survey, 2021

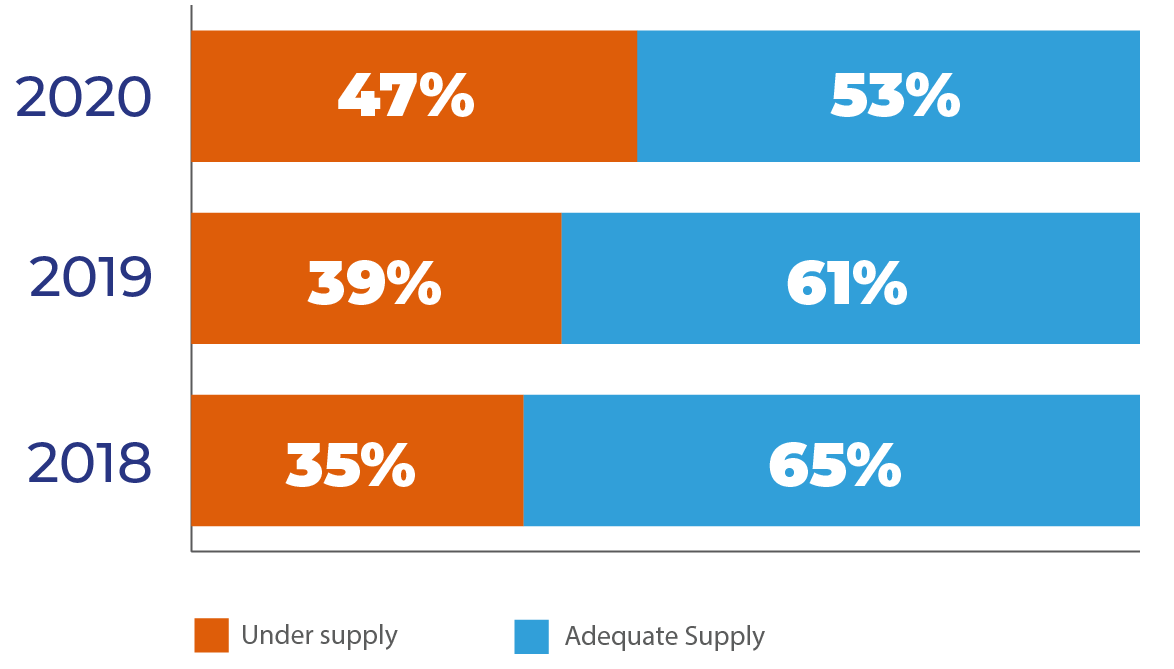

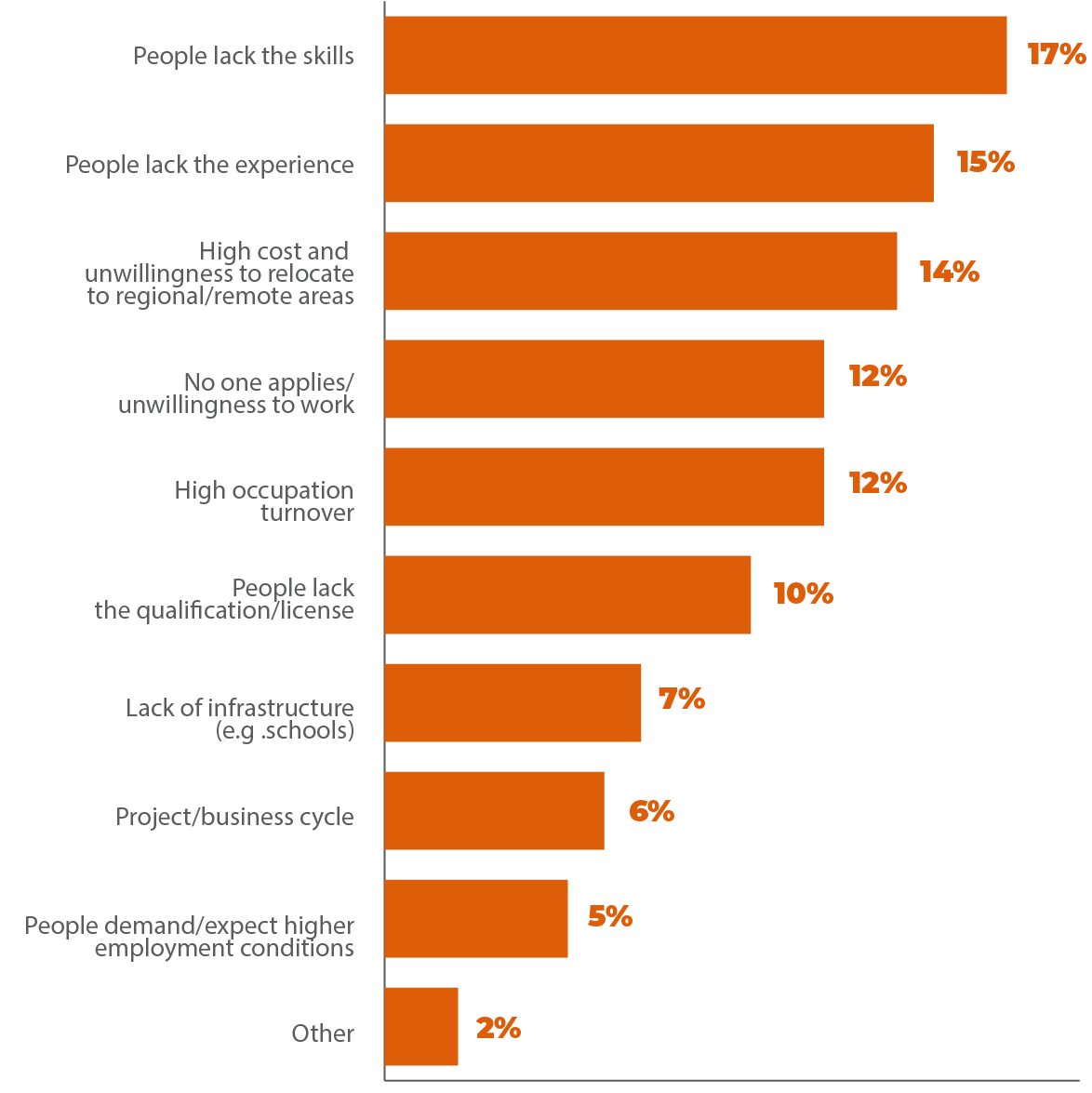

Findings from ISACNT interviews with stakeholders indicated that the construction industry in the NT has faced considerable skills and occupation shortages for the past 3 years (2018-2020). Skill and occupation shortages have increased each year and were heightened in 2020. Primarily, government stimulus packages such as the home improvement scheme and infrastructure upgrades during the outbreak of the COVID-19 pandemic created a boom for the building construction and construction services sub-sectors. Existing workforce shortages, coupled with an increased demand for construction workers due to the boom intensified the challenges. To address the growing workforce challenges in the industry, businesses boost apprentice numbers, adopt multiple recruitment methods and sometimes use other workforce initiatives.

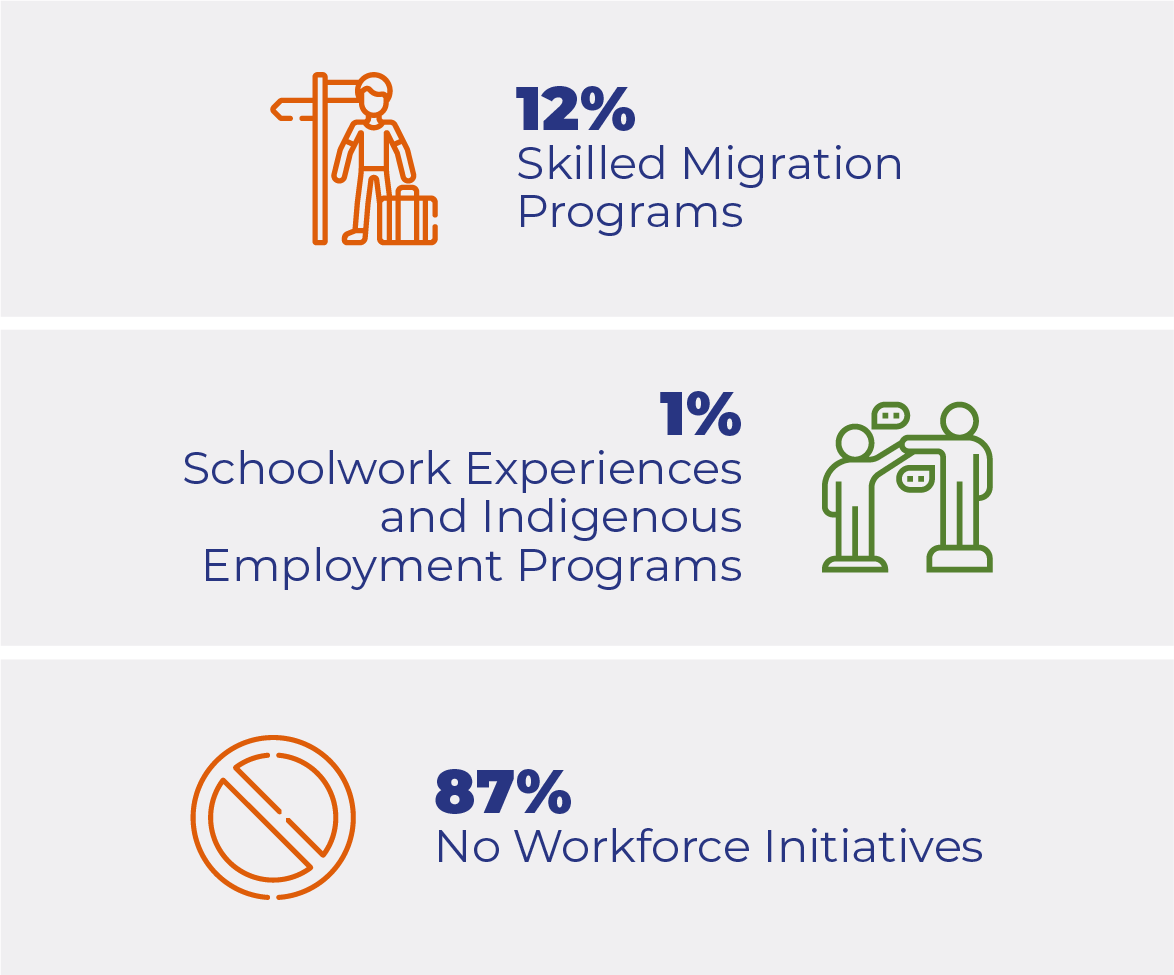

WORKFORCE INITIATIVES

Source: ISACNT Field Survey, 2021

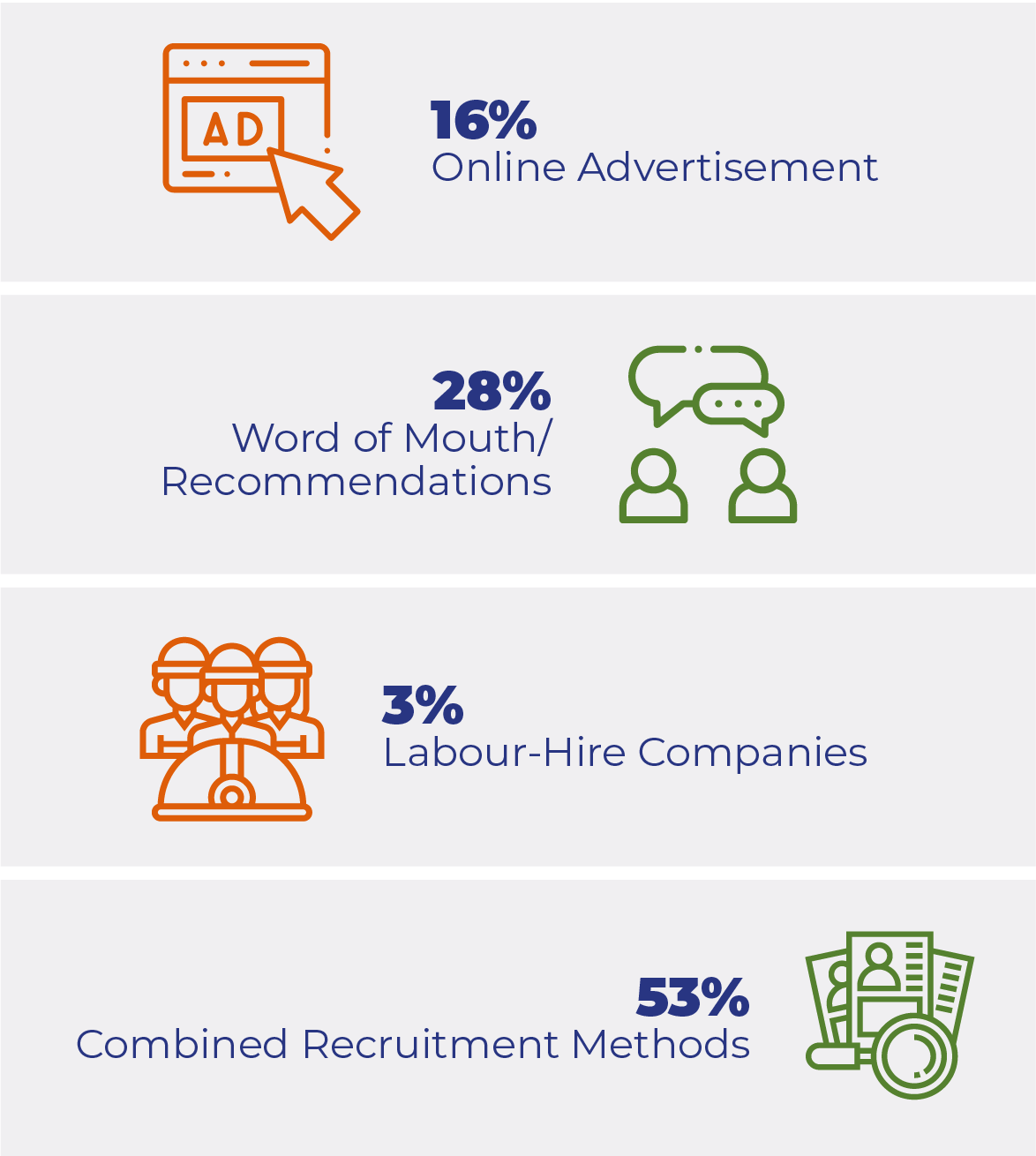

RECRUITMENT METHODS

Source: ISACNT Field Survey, 2021

WORKFORCE SUPPLY TRENDS

Source: ISACNT Field Survey, 2021

REASONS FOR WORKFORCE CHALLENGES

Source: ISACNT Field Survey, 2021

Mental Health

The construction industry workers and apprentices in Australia have been found to be more likely to commit suicide in comparison to other industries. The trend is no different from what is occurring in the Northern Territory as the construction industry has a higher proportion of mental health issues compared to other sectors. ISACNT's engagements with stakeholders indicated that mental health together with poor relationships between employer and apprentices, economic downturns, and apprentices changing careers were some of the primary causes of the declining apprenticeships and traineeships completion rates. Fly-in fly-out construction workers were also found to have a greater risk of mental health issues. These findings were found to worsen workforce challenges and significantly impact project timelines and productivity outcomes. To curb the alarming impact of mental health issues on the industry, the NTG has initiated programs to improve the workforce's well-being with support from the Federal Government and other charitable organisations. Active suicide prevention and awareness training are also delivered across all Territory regions to support the construction industry’s workforce. The support services in the NT as part of the training include, but not limited to, post venture assistance and guidance for workers wanting to process distressing events when accidents and suicides occur. ISACNT’s study also found that approximately 10% of the NT's construction workforce have undertaken mental health and suicide prevention training.

Current State

Strenghts

SOCIO-ECONOMIC

- Existence of the Australian Construction Industry Forum facilitates dialogue between peak bodies and governments

- Availability of the Northern Australian Infrastructure Facility and other funding complement private investments

- Existence of the NT's building regulations standardise construction activities and ensure a competitive industry

- Implementation of the First Home Loan Deposit Scheme, saving buyers the costs of mortgage insurance

- Regular in-house and external safety workshops reduce work-related injuries and fatalities on construction sites

- NTG's keen interest to consult with stakeholders improves policy and results in better outcomes

WORKFORCE AND OCCUPATION

- Willingness of NT businesses to offer work experience/apprenticeship options develop a capable workforce

- Availability of forecasts informing market trends provides accurate market intelligence to guide businesses for future workforce requirements

- Construction apprenticeship mentoring schemes improve completions and enhance career opportunities

- Accessibility to funding for many construction-related apprenticeship programs support the local workforce through employment, training, and mentoring

- Availability of stimulus packages boost industry confidence and provide local jobs

- Existence of mental health programs designed specifically for the construction workforce improve workers' mental health, resilience, and productivity

- Access to building education resources makes it easier for practitioners to understand the National Construction Code

TRAINING AND SKILLS

- Integration of mental health into some RTO's training prepare students to be resilient, providing tools for a better wellbeing

- Collaboration between government and industry delivers efficient training, increasing enrolment and completion numbers

- Existing training packages offer the skills and knowledge that are required, increasing industry's confidence

- Reviewed CPC Construction, Plumbing and Services (CPCCPS) training packages equip graduates with the skills that can be applied in different work contexts

- Foundation skills in the current CPCCPS training packages reflect the workplace requirements and ease student transition into a real work environment

- Existence of experienced/qualified trainers with industry currency enhance the quality of training delivery

Challenges

SOCIO-ECONOMIC

- Difficulty ensuring standardised licencing systems acceptable across all jurisdictions affect the industry

- Digitising construction processes is expensive and may discourage businesses from adapting to the technological changes

- Disagreements and lack of coordination among peak bodies in construction lead to duplication of efforts

- Red tape in the procurement processes make tendering difficult and discourage businesses from submitting tenders

- Lack of regulations in some key construction services in the NT dampens the public's confidence in the sector

- Award of construction tenders to interstate contractors at the expense of local businesses impede local development

WORKFORCE AND OCCUPATION

- Businesses are often faced with inadequately skilled workers to help with the day to day operations

- The often remote nature of communities impedes workers/students possibility of obtaining a qualification and career in hospitality

- High attrition rates in hospitality courses compound existing workforce shortages and challenges

- Continuous fall in hospitality apprenticeships and traineeships have led to limited numbers of newly qualified workers entering the industry

- Restrictions and tightening of skilled migration pathways, partially due to the impacts of COVID-19, have created ongoing challenges

- The high cost of skilled labour in the NT often financially restrains businesses and impedes growth

- Reliance on the overseas workforce to overcome the skills shortage, gaps and recruitment difficulties impede the development of the local workforce

- The seasonal nature and negative perception attached to hospitality work, being temporary positions, makes it unattractive for people to pursue a career in the sector

- The unwillingness of skilled workers to migrate to remote/very remote areas implicate the already present workforce challenges

TRAINING AND SKILLS

- Lack of credit arrangements for pathways to higher education for CPCCPS training packages discourages some professionals from enhancing their career

- Unavailability of some construction courses in the NT at times discourages the youth from pursuing a career

- Limited competition among RTOs delivering construction courses may affect the quality of training

- Slow process in aligning new technologies to training packages could make it difficult for trainees, adapting to industry practice

- Lack of course delivery in most remote and very remote areas of the NT serve as a barrier to obtain a qualification

- Transition of some construction course units from face-to-face to online may impact the quality of deliver

Future State

Opportunities

SOCIO-ECONOMIC

- Implementation of the recommendations of the Building Confidence Report may improve regulatory compliance and increase the public's trust in the industry

- Only allowing qualified/registered building practitioners to design, construct and maintain buildings may reduce compliance issues

- Implementation of the national plan on energy efficiency may improve building's energy consumption

- Governments focus on infrastructure spending will stimulate the growth of the construction industry

- Coordination among peak bodies may assist the industry in acquiring a uniform voice, improving growth

- Implementation of the new Roads of Strategic Importance (ROSI) initiative could enhance connections between agricultural regions, ports, tourism, mining and other sectors

WORKFORCE AND OCCUPATION

- Implementation of the compulsory continuing professional development could maintain and develop the skills, knowledge, and competence of workers

- Retention of experienced and skilled workers with good work ethic will keep the industry more competitive

- Allowing Year 10 and 11 students to leave school to secure apprenticeships with tradespersons may boost the workforce numbers

- Improving the profile of VET courses could increase the size of the workforce and reduce recruitment difficulties

- Implementation of streamlined incentive programs for employers to hire apprentices/trainees may increase the workforce numbers

- Extension of the boosting apprenticeship commencement wage subsidy initiative encourages employers to engage more apprentices

- Implementing an evidence-based initiative to sustain the workforce during market downturns will address the ongoing challenges

- More diversified construction workforce will harness more out-of-the-box-thinking and sustainable growth

TRAINING AND SKILLS

- Design and delivery of the 'train the trainer' courses in construction may provide experienced workers with the teaching skills needed to mentor the younger workforce

- Increased training support from both government and industry could improve the skills and size of the workforce

- Introduction of a national system that recognises licences across jurisdictions may increase workers mobility

- Quicker integration of emerging technologies into construction training packages will better equip trainees with the skills to adapt to the evolving industry

- Implementation of the National Training Framework for Temporary Traffic Management standardises training delivery and may ease qualification recognition

Threats

SOCIO-ECONOMIC

- Increased downturn in the construction market may reduce consumer investment confidence and impede the growth of the sector

- Completion of major construction projects without starting new ones will hinder growth

- Changes in market conditions may impact costs in the execution of residential and commercial construction that will increase property prices and inhibit the sector's growth

- Increased bureaucratic tendering processes could stifle development

- Instability of the exchange rate of the Australian Dollar may affect the importation of construction materials and destabilise the budget of construction projects

- Keen competition for scarce government resources from other industries could impact infrastructural investments in the NT

WORKFORCE AND OCCUPATION

- Increased automation of more construction processes may result in the displacement of parts of the workforce

- Decreased investment in construction may result in the loss of the NT's workforce to other industries or states

- Lack of a workforce development plan for the construction industry will impede the sector's ability to sustain labour needs

- Increased shortage of skilled workers may result in high labour costs, leading to the closure of local businesses

- Lower completion numbers in trade courses may exacerbate recruitment difficulties

- Competition for skilled workers from other industries providing attractive job opportunities may worsen workforce challenges

- Acute shortages of skilled workforce will affect project timelines and trust in the industry to achieve key targets

- Execution of the National Training Framework for Temporary Traffic Management (NTFTTM) may affect workforce numbers for some higher road categories

- Decrease in qualified trades professionals leave businesses with less options to take on apprentices

TRAINING AND SKILLS

- Evolving changes in the industry will come with emerging occupations with no training delivered in the NT

- Residents from the NT undertaking training in other states may not return, exacerbating the workforce issues

- Increased difficulty in attracting professionals into teaching roles in the NT may affect the quality of training

- Closure of some training organisations in the NT will result in declining enrolment and completion numbers

- Changes to certain qualifications, such as the NTFTTM, extending study time may discourage some workers from staying/entering the industry

Occupations in Demand

Developing and enhancing the skills and capabilities of the workforce at optimum levels is critical for the growth of the construction industry in the NT. However, in the past few years, the NT's construction industry has witnessed and continues to encounter untenable skills and occupation shortages in numerous trades.

Source: ISACNT Field Survey, 2021

Note: Diesel mechanic is in another industry occupations.

Skills in Demand

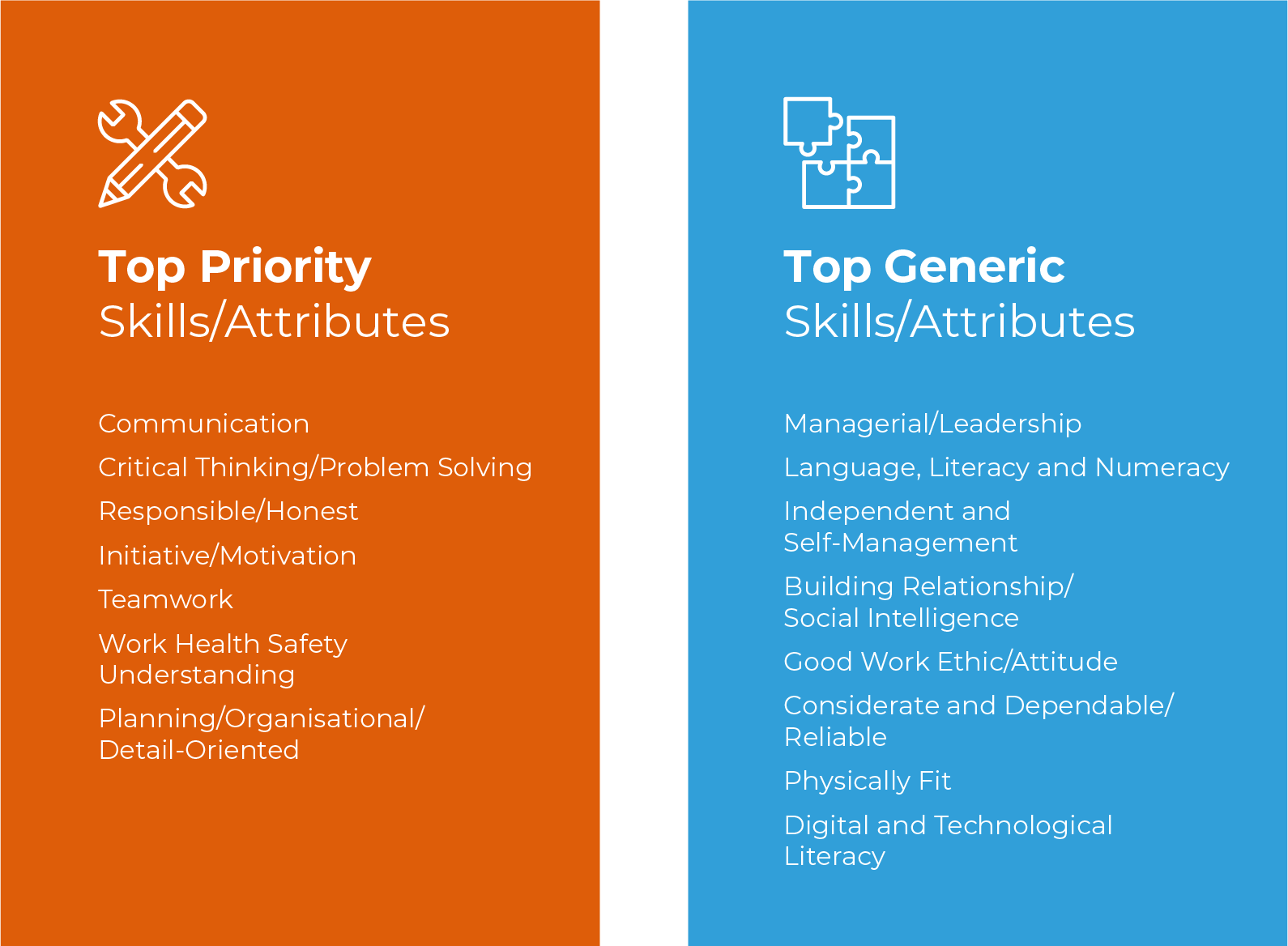

Vocational Education and Training (VET) and the construction industry interrelate with each other. While the construction industry relies extensively on VET for its workforce, the construction industry also provides feedback to the VET sector to improve training packages and deliveries. Like elsewhere in Australia, the NT's construction industry is gradually becoming technologically driven, adopting building information modelling and automation into its activities. This has triggered changes in the way projects are managed and the skills required to work in the sector. ISACNT's stakeholder engagement uncovered a number of skills/attributes (top priority and generic) needed to thrive in the industry. In addition, most stakeholders indicated that having a truck licence and multi-trade skills are desirable and advantageous for most construction professions. Findings from the interviews showed that emerging skills for new technologies not being taught as part of the construction training packages are learnt through in-house training and professional workshops.

Source: ISACNT Field Survey, 2021 and Construction, Plumbing and Services IRC Skills Forecast and Schedule of Work 2019

Occupations

AIR CONDITIONING AND REFRIGERATION MECHANIC

ANZSCO # 342111 Assembles, installs, maintains and repairs industrial, commercial and domestic air conditioning and refrigeration systems and equipment. Registration or licensing may be required.

Skill Level: 3

Skill sets:

Troubleshooting, repairing, equipment selection and maintenance, installation, quality control analysis, reading comprehension, operation control and monitoring, coordination with others, complex problem solving, time management, system analysis, and instructing.

Certificate II in Split Air Conditioning and Heat Pump Systems

Certificate III in Air Conditioning and Refrigeration

Certificate IV in Air Conditioning and Refrigeration Servicing

OR

Certificate IV in Electrical - Air Conditioning Split Systems

Diploma of Electrical and Refrigeration and Air Conditioning

OR

Diploma of Engineering Technology - Refrigeration and Air Conditioning

OR

Diploma of Air Conditioning and Refrigeration Engineering

Advanced Diploma of Engineering Technology - Air Conditioning and Refrigeration

BRICKLAYER

ALTERNATIVE TITLE: BLOCKLAYER

ANZSCO # 331111 Lays bricks, pre-cut stone, and other types of building blocks in mortar to construct and repair walls, partitions, arches, and other structures. Registration or licensing may be required.

Skill Level: 3

Skill sets: Mathematics, coordination with others, operation control and monitoring, quality control analysis, critical thinking, active learning and listening, time management, complex problem solving, reading comprehension and writing, equipment selection and maintenance, management of material and personnel, resources, and persuasion.

Certificate III in Bricklaying and Blocklaying

BUILDING INSPECTOR

ALTERNATIVE TITLES: BUILDING CERTIFIER, BUILDING SURVEYOR

ANZSCO # 312113 Inspects buildings to ensure compliance with laws and regulations and advises on building requirements. Registration or licensing may be required.

Skill Level: 2

Skill sets:

Critical thinking, reading comprehension and writing, active listening and learning, judgement and decision making, mathematics, complex problem solving, system analysis and evaluation, instructing, time management, and management of personnel resources.

Diploma of Building and Construction (Building)

Advanced Diploma of Building Surveying

Bachelor of Building Surveying

OR

Bachelor of Construction Management

CABINET MAKER

ANZSCO # 394111 Fabricates or repairs wooden furniture and fits and assembles prepared wooden parts to make furniture.

Skill Level: 3

Skill sets:

Quality control analysis, operation monitoring and control, critical thinking, mathematics, time management, equipment selection and maintenance, judgement and decision making, operation control, analysis and monitoring, troubleshooting, active learning and listening, complex problem solving, reading comprehension and writing, coordination with others, and repairing.

Certificate II in Furniture Making Pathway

Certificate III in Cabinet Making

OR

Certificate III in Furniture Making

CARPENTER AND JOINER / CARPENTER / JOINER

Carpenter and Joiner ANZSCO # 331211 Constructs and installs structures and fixtures of wood, plywood, and wallboard, and cuts, shapes and fits timber parts to form structures and fittings. Registration or licensing may be required.

Skill Level: 3

Carpenter ANZSCO # 331212 Constructs, erects, installs, renovates and repairs structures and fixtures of wood, plywood, wallboard and other materials. Registration or licensing may be required.

Skill Level: 3

Joiner ANZSCO # 331213 Cuts, shapes and fits timber parts in workshops to form structures and fittings, ready for installation. Registration or licensing may be required.

Skill Level: 3

Skill sets:

Coordination with others, critical thinking, equipment selection, troubleshooting, repairing, active learning and listening, reading comprehension and writing, time management, complex problem solving, judgement and decision making, quality control analysis, management of personnel resources, and mathematics.

Certificate II in Construction

Certificate III in Carpentry

OR

Certificate III in Carpentry and Joinery

Certificate III in Shopfitting

OR

Certificate III in Joinery

CIVIL ENGINEER

ANZSCO # 233211 Plans, designs, organises, and oversees the construction and operation of dams, bridges, pipelines, gas and water supply schemes, sewerage systems, airports, and other civil engineering projects. Registration or licensing may be required.

Skill Level: 1

Skill sets:

Mathematics, reading comprehension, operation analysis and monitoring, critical thinking, active learning and listening, system analysis and evaluation, complex problem solving, judgement and decision making, time management, coordination with others, science, instructing, and management of personnel resources.

Bachelor of Engineering Science

CONCRETERS

ALTERNATIVE TITLE: CONCRETE WORKER

ANZSCO # 821211 Pours, spreads, smoothes, and finishes concrete for structures such as floors, stairs, ramps, footpaths and bridges.

Skill Level: 5

Skill sets:

Operation control and monitoring, coordination with others, time management, complex problem solving, quality control analysis, critical thinking, active learning and listening, management of personnel resources, judgement and decision making.

Certificate III in Concreting

DIESEL MECHANIC

ANZSCO # 321212 Maintains, tests and repairs diesel motors and the mechanical parts of trucks, buses, and other heavy vehicles such as transmissions, suspension, steering and brakes. Registration or licensing may be required.

Skill Level: 3

Skill sets:

Repairing, troubleshooting, critical thinking, equipment maintenance, quality control analysis, operation control and monitoring, active learning and listening, equipment selection, coordination with others, and system evaluation.

Certificate III in Automotive Diesel Engine Technology

OR

Certificate III in Automotive Diesel Fuel Technology

OR

Certificate III in Heavy Commercial Vehicle Mechanical Technology

EARTHMOVING PLANT OPERATOR (GENERAL)

ALTERNATIVE TITLE: CONSTRUCTION PLANT OPERATOR (GENERAL)

ANZSCO # 721211 Operates a range of earthmoving plant to assist with building roads, rail, water supply, dams, treatment plants and agricultural earthworks. Registration or licensing is required.

Skill Level: 4

Skill sets:

Operation control and monitoring, coordination with others, equipment selection and maintenance, troubleshooting, active learning and listening, critical thinking, quality control analysis, repairing, judgement and decision making, instructing, reading comprehension and writing.

Certificate II in Civil Construction

Certificate III in Civil Construction Plant Operations

ELECTRICIAN (GENERAL)

ALTERNATIVE TITLE: ELECTRICAL FITTER

ANZSCO # 341111 Installs, tests, connects, commissions, maintains, and modifies electrical equipment, wiring and control systems. Registration or licensing is required.

Skill Level: 3

Skill sets:

Troubleshooting, critical thinking, installation, repairing, equipment maintenance, quality control analysis, reading comprehension, complex problem solving, active learning and listening, instructing, operation control and monitoring, mathematics, judgement and decision making.

Certificate II in Electrotechnology (Career Start)

Certificate III in Electrotechnology Electrician

OR

Certificate III in Electrical Fitting

Certificate IV in Electrotechnology - Systems Electrician

OR

Certificate IV in Hazardous Areas – Electrical

OR

Certificate IV in Electrical Instrumentation

Certificate IV in Electrical Equipment and Systems

FIBROUS PLASTERER / SOLID PLASTERER

Fibrous Plasterer ANZSCO # 333211 Apply and fix plasterboard partitions, suspended ceilings, fire rating systems, acoustic tiles, and composite wall linings to buildings, and apply decorative and protective coverings of plaster, cement and similar materials to the interiors and exteriors of structures.

Skill Level: 3

Solid Plasterer ANZSCO # 333212 Applies decorative and protective coverings of plaster, cement and similar materials to the interiors and exteriors of structures.

Skill Level: 3

Skill sets:

Coordination with others, reading comprehension and writing, critical thinking, complex problem solving, time management, active learning and listening, quality control analysis, mathematics, instructing, management of personnel, and equipment selection.

Certificate III in Solid Plastering

OR

Certificate III in Wall and Ceiling Lining

GASFITTER

ANZSCO # 334114 Installs, maintains, and repairs gas mains, piping systems downstream of the billing meter, and appliances and ancillary equipment associated with the use of fuel gases, including liquefied petroleum gas systems. Registration or licensing is required.

Skill Level: 3

Skill sets:

Coordination with others, active learning and listening, complex problem solving, critical thinking, quality control analysis, reading comprehension and writing, time management, judgement and decision making, equipment selection and maintenance, instructing, system analysis and evaluation, operation control and monitoring.

Certificate III in Gas Fitting

GLAZIER

ANZSCO # 333111 Measures, cuts, finishes, fits and installs flat glass and mirrors.

Skill Level: 3

Skill sets:

Coordination with others, monitoring, active listening, critical thinking, operation control and monitoring, reading comprehension and writing, time management, judgement and decision making, mathematics, quality control analysis, instructing, installation, and management of personnel resources.

Certificate II in Glass and Glazing

Certificate III in Glass and Glazing

Certificate IV in Glass and Glazing

Diploma of Stained Glass and Leadlighting

LINE MARKER

ALTERNATIVE TITLES: ROAD MARKER

ANZSCO # 721912 Operates plant to apply markings to roads and other surfaces such as car parks, airports, and sportsgrounds. Registration or licensing is required.

Skill Level: 4

Skill set:

Coordination with others, operation control and monitoring, solving complex problems, quality control analysis, critical thinking, troubleshooting, equipment maintenance and repairing, active listening and learning, time management, judgement and decision making.

Certificate III in Civil Construction

METAL FABRICATOR

ANZSCO # 322311 Marks off and fabricates structural steel and other metal stock to make or repair metal products and structures such as boilers and pressure vessels.

Skill Level: 3

Skill sets:

Active listening and learning, coordination with others, reading comprehension and writing, quality control analysis, judgement and decision, operation control and monitoring, judgement and decision making, time management, critical thinking, complex problem solving, persuasion, troubleshooting, and instructing equipment selection.

Certificate II in Engineering

Certificate III in Engineering - Fabrication Trade

Certificate IV in Engineering

PAINTING TRADES WORKER

ANZSCO # 332211 Applies paint, varnish, wallpaper, and other finishes to protect, maintain and decorate surfaces of buildings and structures. Registration or licensing may be required.

Skill Level: 3

Skill sets:

Active listening and learning, critical thinking, reading comprehension and writing, coordination with others, time management, judgement and decision making, complex problem solving, operation monitoring and control, persuasion, and mathematics.

Certificate III in Painting and Decorating

PLUMBER (GENERAL)

ANZSCO # 334111 Installs and repairs water, drainage, gas and sewerage pipes and systems. Registration or licensing is required.

Skill Level: 3

Skill sets:

Critical thinking, repairing, coordination with others, quality control analysis, active learning and listening, complex problem solving, operation control and monitoring, judgement and decision making, equipment maintenance, instructing, troubleshooting, and time management.

Certificate III in Plumbing

Certificate IV in Plumbing and Services

PROJECT BUILDER / CONSTRUCTION PROJECT MANAGER

ALTERNATIVE TITLES: PROFESSIONAL BUILDER / BUILDING AND CONSTRUCTION MANAGER

Project Builder ANZSCO # 133112 Plans, organises, directs, controls and coordinates the construction, alteration and renovation of dwellings and other buildings, and the physical and human resources involved in the building process. Registration or licensing is required.

Skill Level: 1

Construction Project Manager ANZSCO # 133111 Plans, organises, directs, controls and coordinates construction of civil engineering and building projects, and the physical and human resources involved in the construction process. Registration or licensing is required.

Skill Level: 1

Skill sets:

Coordination with others, operation control and monitoring, critical thinking, active learning and listening, reading comprehension and writing, time management, judgement and decision making, management of material, financial and personnel resources, complex problem solving, system analysis, persuasion, and mathematics.

Certificate IV in Building and Construction

Diploma of Building and Construction (Building)

OR

Diploma of Building and Construction (Management)

Advanced Diploma of Building and Construction (Management)

Bachelor of Construction Project Management

OR

Bachelor of Construction Management

QUANTITY SURVEYOR

ALTERNATIVE TITLES: BUILDING ECONOMIST, CONSTRUCTION ECONOMIST

ANZSCO # 233213 Estimates and monitors construction costs from the project feasibility stage, through tender preparation, to the construction period and beyond. Registration or licensing is required.

Skill Level: 1

Skill sets:

Critical thinking, mathematics, active listening and learning, management of material and financial resources, judgement and decision making, complex problem-solving skills, coordination with others, time management, and system evaluation.

Bachelor of Quantity Surveying

OR

Bachelor of Construction Management and Economics

ROOF TILER

ANZSCO # 333311 Cover roofs with tiles, sheets, and shingles to form a waterproof surface. Registration or licensing may be required.

Skill Level: 3

Skill sets: Coordination with others, critical thinking, operation control and monitoring, active learning and listening, complex problem solving, time management, reading comprehension and writing, judgement and decision making, quality control analysis, instructing, and management of personnel.

Certificate III in Roof Tiling

SURVEYOR

ALTERNATIVE TITLES: GEOMATICIAN, GEOMATIC ENGINEER

ANZSCO # 232212 Plans, directs and conducts survey work to determine, delineate, plan and precisely position tracts of land, natural and constructed features, coastlines, marine floors and underground works, and manages related information systems. Registration or licensing may be required.

Skill Level: 1

Skill sets:

Reading comprehension, mathematics, critical thinking, management of personnel resources, coordination with others, instructing, time management, writing, active learning and listening, complex problem solving, operation control and monitoring, system analysis, judgement and decision making.

Certificate II in Surveying and Spatial Information Services

Certificate III in Surveying and Spatial Information Services

Certificate IV in Surveying and Spatial Information Services

Diploma of Surveying

OR

Diploma of Spatial Information Services

Advanced Diploma of Building Surveying

Bachelor's Degree of Building Surveying

WALL AND FLOOR TILER

ANZSCO # 333411 Lay ceramic, clay, slate, marble, and glass tiles on external and internal walls and floors to provide protective and decorative finishes. Registration or licensing may be required.

Skill Level: 3

Skill sets:

Coordination with others, critical thinking, mathematics, active learning and listening, instructing, reading comprehension and writing, time management, complex problem solving, judgement and decision making, quality control analysis, and management of personnel resources.

Certificate III in Wall and Floor Tiling

Enrolments and Completions

Resources

http://www.governessaustralia.com/info/whatisagoverness.html

https://nteconomy.nt.gov.au/industry-analysis/agriculture,-foresty-and-fishing

https://www.agriculture.gov.au/abares/products/insights/snapshot-of-australian-agriculture-2020

https://www.pc.gov.au/research/completed/agriculture/agriculture.pdf

https://www.austrade.gov.au/agriculture40

https://economy.id.com.au/rda-northern-territory/value-add-by-industry

https://ntfarmers.org.au/wp-content/uploads/2018/11/2019HarvestReport_Final.pdf

https://ntfarmers.org.au/wp-content/uploads/2018/11/2018-Harvest-Labour-Report.pdf

https://ntfarmers.org.au/wp-content/uploads/2018/11/NT-2017-Harvest-Labour-Report-Final.pdf

https://industry.nt.gov.au/__data/assets/pdf_file/0004/948748/economic-overview-2018-2019.pdf

https://dpir.nt.gov.au/__data/assets/pdf_file/0005/443255/outlook-overview-2016.pdf

https://www.agriculture.gov.au/abares/research-topics/aboutmyregion/nt

https://nteconomy.nt.gov.au/industry-analysis/agriculture,-foresty-and-fishing

https://publications.csiro.au/rpr/download?pid=csiro:EP186191&dsid=DS3